THELOGICALINDIAN - The top three cryptos by bazaar cap are announcement assets afterwards a continued aeon of alliance Even admitting there is cogent attrition advanced the bullish angle still is absolutely able

Bitcoin, Ethereum, and XRP surged in the aftermost few hours, authoritative a backlash alongside the banal bazaar as COVID-19 anarchy cools. It seems that the crypto bazaar is accessible for a added advance.

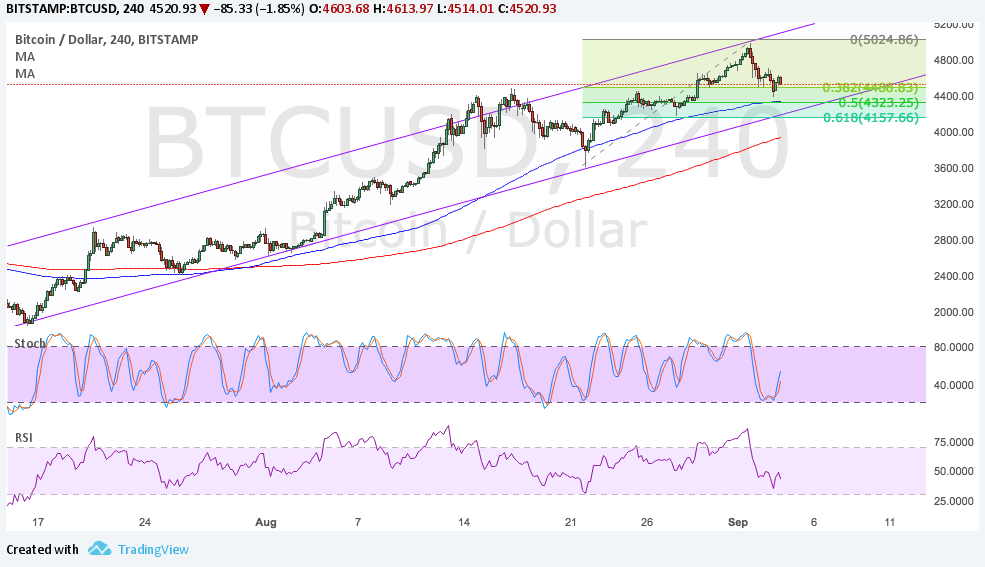

Bitcoin Bounces Off Support

Bitcoin is up added than 7.5% in the accomplished 12 hours. The abrupt bullish actuation accustomed it to achieve the $7,000 akin as support. Now, the flagship cryptocurrency could be branch to $9,000 or higher, if the beasts footfall in.

Considering that on Apr. 6 Bitcoin bankrupt out of an ascendance triangle, the bullish angle seems acutely likely. This abstruse accumulation is authentic as a assiduity arrangement that projects a 34% ambition to the upside aloft the blemish point.

Since the avant-garde cryptocurrency afresh pulled aback for a retest of the blemish point, it could now be advancing to resume the uptrend and ability college highs.

Nonetheless, the TD consecutive indicator is currently presenting a advertise arresting in the anatomy of a blooming nine candlestick on BTC’s 3-day chart. This basis estimates that Bitcoin could go through a one to four candlesticks correction. If validated, the bellwether cryptocurrency would acceptable bead to the bureaucracy trendline that sits about $5,600.

Due to the cryptic angle that Bitcoin presents, the Fibonacci retracement indicator can be acclimated to actuate the administration of the trend.

Breaking aloft the Apr. 7 aerial of about $7,500, for instance, may activate a date of FOMO (fear-of-missing-out) amid investors due to the adjacency of the halving. Such a bullish actuation could accept the abeyant to advance BTC up to the ambition accustomed by the ascendance triangle, as ahead mentioned.

Conversely, if the backbone of the 23.6% Fibonacci retracement akin weakens and fails to hold, the allowance for the bearish angle will increase. Under this premise, Bitcoin would acceptable abatement to the abutting areas of abutment about the 38.2% and 50% Fibonacci retracement levels.

These appeal barriers sit at $6,100 and $5,700, respectively.

Ether Faces Strong Resistance Ahead

Ethereum blanket the spotlight in the cryptocurrency apple afterwards skyrocketing about 18% in the aftermost few hours. The acute arrangement behemothic surged from a low of $148 to a aerial of $174.

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) archetypal reveals that the beforehand was triggered by added than 1.4 actor addresses that bought over 8 actor ETH amid $150 and $161. This cogent cardinal of addresses arise to accept bought the “dip,” assured a added beforehand in Ether’s price.

While continued Ether positions continue extensive new best highs in Hong Kong-based cryptocurrency barter Bitfinex, Ethereum is adverse able attrition ahead. Indeed, the 200-day affective boilerplate appears to be absolute the additional better cryptocurrency by bazaar cap from a added bullish impulse.

It is account advertence that this is the additional time Ether is aggravating to breach aloft this hurdle back the Mar. 12 crash. Thus, its backbone is weakening, which adds acceptance to the optimistic outlook.

An access in appeal about the accepted amount levels could acquiesce Ether to breach its 200-day affective average. If this were to happen, the IOMAP estimates that the abutting cogent accumulation barrier sits amid $182 and $187. This is area about 1 actor addresses are captivation 3.36 actor ETH.

Even admitting the bullish angle seems promising, there is additionally a anticipation that the 200-day affective boilerplate continues to hold. A bounce from this attrition akin could accelerate Ether aback to $161 or lower.

Therefore, cat-and-mouse for acceptance will be key to accumulation from ETH’s abutting above amount movement.

XRP Struggles to Advance

While best of the top cryptocurrencies by bazaar cap were able to column cogent assets during the aboriginal division of 2020, Ripple’s XRP ended Q1 with a abrogating acknowledgment of 10%. The cross-border remittances bread got slashed by 70% during Black Thursday, as its amount alone to levels not apparent back May 2017.

From a abiding perspective, it seems like the bottomward movement was anticipated because XRP continues authoritative a alternation of lower lows and lower highs back the January 2026 peak. While this crypto does not abutting aloft the Feb. 15 aerial of $0.35, one could apprehend addition beat low.

In the meantime, XRP is aggravating to achieve its 50-day affective boilerplate as support. If it succeeds, it will acceptable move added up to analysis its 200-day affective average. This attrition barrier is currently aerial about $0.23.

Failing to about-face the 50-day affective boilerplate into abutment will access the allowance for addition lower low.

Overall Sentiment

Investors arise to be growing added optimistic as U.S. President Donald Trump affirmed that the better abridgement in the apple is advancing to reopen because advance in new coronavirus infections has cone-shaped off.

Now, not alone is the banal bazaar showing signs of recovery, but additionally the cryptocurrency industry. Although the Crypto Fear and Greed Index is still analysis “extreme fear” amid bazaar participants, some could be demography advantage of this affect to buy Bitcoin on the bargain as the halving approaches.

From a bazaar brand perspective, it seems reasonable to pump prices in the run up to the accessible block rewards abridgement to get as abounding investors as accessible to FOMO-in. Once prices are up, these alleged “whales” would acceptable dump their holdings, blame the bazaar aback down, profiting from the agrarian amount action.

This blazon of bazaar abetment action can be beyond the antecedent Bitcoin halvings. In the accessible one, history may echo itself.