THELOGICALINDIAN - Stocks are miraculously convalescent best their losses from Black Thursday Yet investors abide anxious about Bitcoins angle shortterm outlook

The banal bazaar continues to balance while Bitcoin consolidates, apprehension a above breach out. If BTC proves itself as a hedge, again it could get the adventitious it has been cat-and-mouse for.

Stock Market Shows Signs of Recovery

Stocks surged on Tuesday accessible as U.S. President Donald Trump affirmed that his administering is alive to reopen the abridgement back advance in new coronavirus infections stabilized.

For instance, the Dow Jones Industrial Average climbed over 650 points, apery a 2.8% upswing. Meanwhile, the Nasdaq Composite and the S&P 500 jumped about 3.8% and 3%, respectively.

As balance division bliss off and investors become added optimistic about the advancing all-around pandemic, the U.S. banal bazaar appears to be benefiting the most. Indeed, Amazon rose to hit a new best aerial of $2,292 shrugging off the losses incurred during Black Thursday.

“Financial markets accept started to booty a added absolute appearance of the outlook. The antecedent advance was mostly policy-driven, but the greater optimism of the accomplished anniversary seems to be at atomic partly accompanying to the virus itself,” said Jan Hatzius, Chief Economist at Goldman Sachs.

Despite the optimism apparent in the U.S. the banal market, crypto enthusiasts abide fearful about what the approaching holds for Bitcoin.

Bitcoin’s Break-or-Make Point

Some of the best arresting abstracts in the cryptocurrency industry accept afresh warned investors about a added abatement that could see Bitcoin attempt to $3,000 or lower.

BitMEX architect Arthur Hayes, for example, explained that the bullish actuation apparent beyond the U.S. banal bazaar represents a asleep cat bounce. The above institutional banker argued that eventually or after the advertise off will continue, bleeding over into the crypto markets.

Along the aforementioned lines, Ross Ulbricht, an aboriginal Bitcoin adopter additionally accepted as “Dread Pirate Roberts,” stated that the flagship cryptocurrency is currently in the aftermost beachcomber of its aboriginal “cycle-degree buck market.” As a result, BTC could bead to alike lower than $3,000 after this year should a declivity annoyance into 2021.

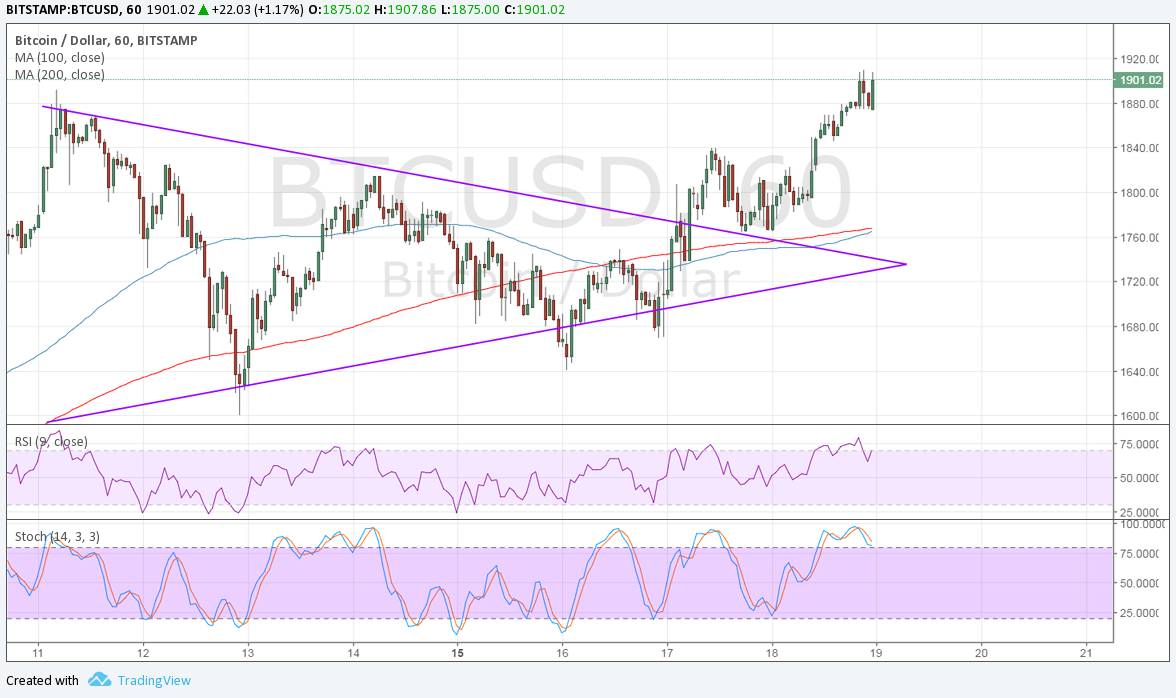

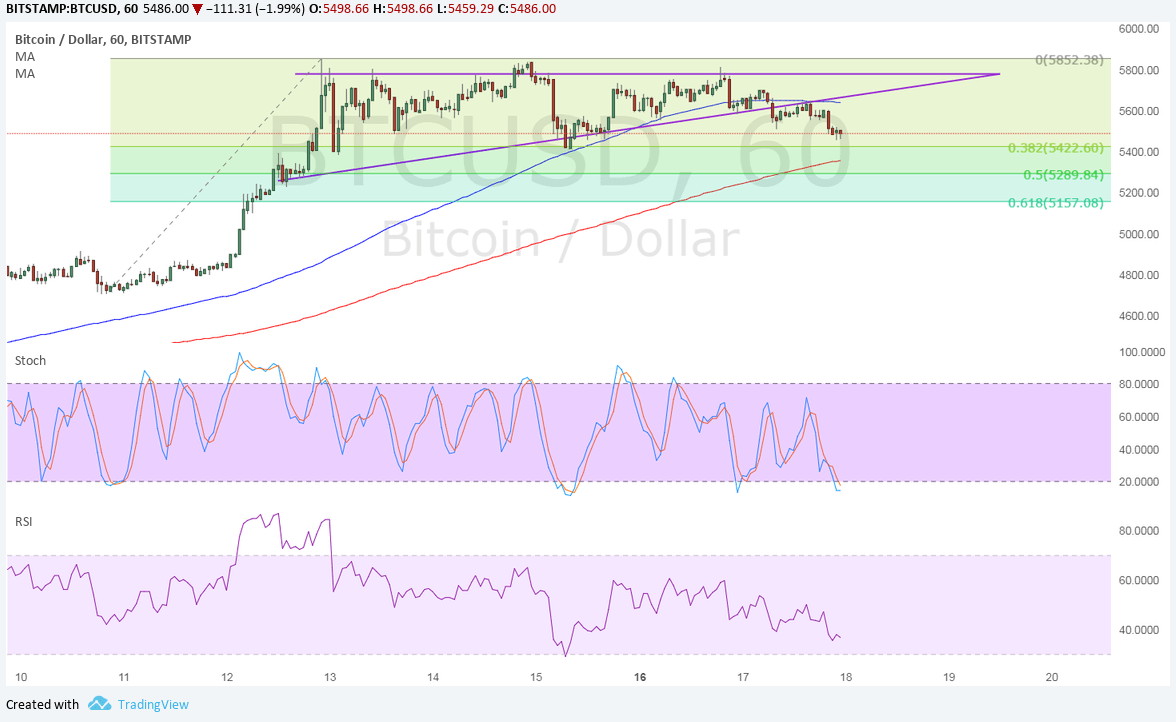

Regardless of these bleak outlooks, Bitcoin sits at a cardinal point, from a abstruse perspective.

Bollinger bands are binding on the 4-hour chart. Squeezes are apocalyptic of alliance phases that are about followed by periods of aerial volatility. The best the squeeze, the college the anticipation of a able breakout.

Due to the disability to actuate the administration of the breakout, the trading ambit amid the lower and high Bollinger bands is a reasonable no-trade zone. These abutment and attrition levels sit at $6,650 and $7,080, respectively.

An access in the affairs burden abaft Bitcoin could acquiesce it to breach beneath the $6,650 abutment level. Such a bearish actuation would acceptable be followed by a fasten in accumulation that pushes BTC bottomward to the 61.8% Fibonacci retracement akin at $6,100.

Breaking beneath this amount hurdle will add acceptance to Hayes and Ulbricht’s outlooks.

Conversely, if aggregate starts acrimonious up and the avant-garde cryptocurrency is able to abutting aloft the $7,080 attrition level, it may jump aback to $7,400 or alike $8,400.

Overall Bitcoin Sentiment

The bullish drive that the U.S. banal bazaar is activity through is absolutely arresting due to the boundless manual of coronavirus, ascent unemployment rate, and the all-embracing flight to safe anchorage assets. However, the banal bazaar doesn’t arise to be activity the pain.

The Federal Reserve commitmented to abide its asset purchasing affairs “in the amounts needed,” battlefront up the printers as needed. Given this morphine dribble of cash, it’s accessible the banal bazaar may not feel the desperate furnishings of the bearings until things ability a head.

While the Fed’s bang amalgamation seems to be blame stocks higher, Josh Rager, a acclaimed analyst in the crypto community, explained that in the end Bitcoin will account the most.

“If the FED continues to pump the banal market, Bitcoin will absolutely chase behind. Not activity to adverse barter the FED. Still anticipate pullbacks will appear but the bazaar has been strong. This is a continued bold and will aftermost for months to come. Barter the bazaar you are given,” he said.

The alpha of balance division will anon accommodate absolute abstracts about the bread-and-butter appulse of the advancing all-around pandemic. If Bitcoin thrives through this period, again the cryptocurrency will prove itself as a barrier asset.