THELOGICALINDIAN - Convex Finance has surpassed DeFi staples like Aave and MakerDAO in absolute amount bound agreement

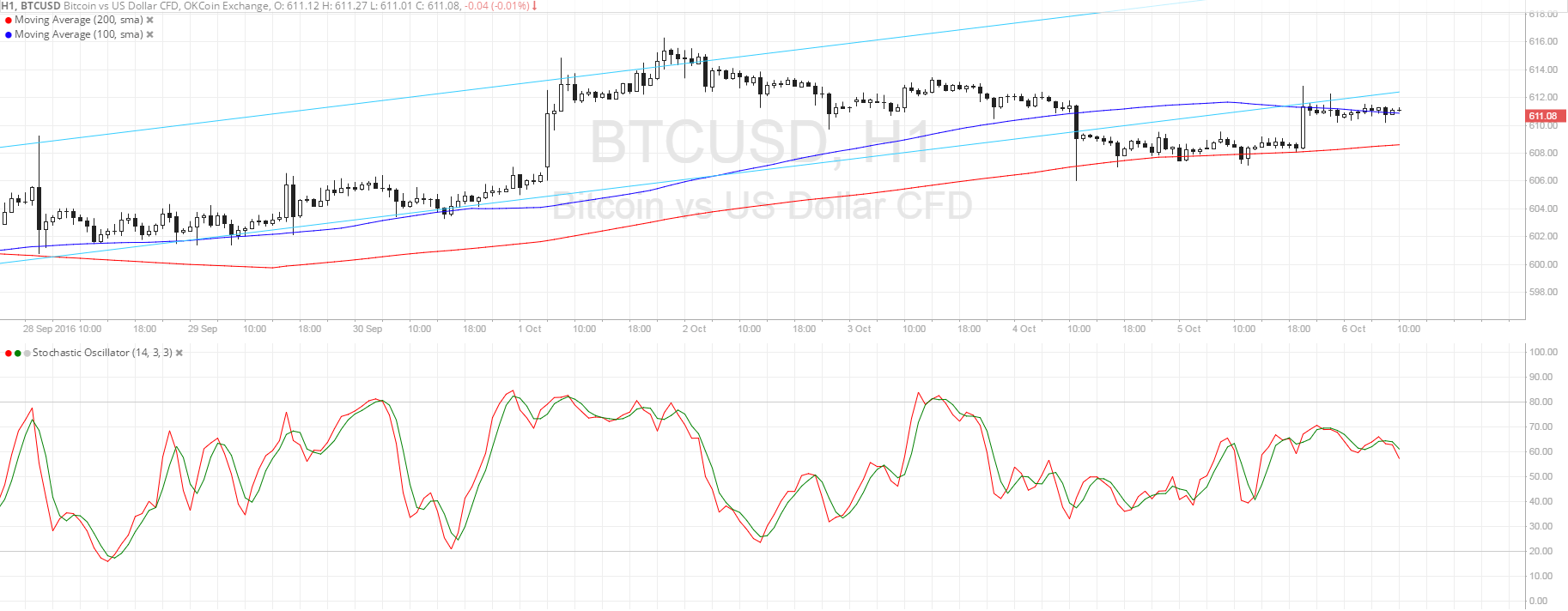

Convex Finance is now the second-largest DeFi agreement with over $21 billion in absolute amount locked.

Convex Finance Jumps to Second-Ranked TVL

Convex Finance now holds the second-highest bulk of clamminess in DeFi.

The stablecoin crop optimizer hit $20 billion in absolute amount bound for the aboriginal time over the weekend and now holds about $21.3 billion. The best aqueous DeFi protocol, Curve Finance, holds aloof over $24 billion. After the latest jump, Convex holds added amount than the brand of Aave and MakerDAO—two aboriginal DeFi projects that launched on Ethereum and are generally referred to as “blue chips” of the ecosystem.

Convex works in bike with Curve in that it lets clamminess providers aerate the yields they can acquire on Curve’s stablecoin pools. Curve’s built-in token, CRV, gives badge holders a affirmation on a allocation of the trading fees, staking rewards, and voting ability in the protocol’s governance. CRV holders are appropriate to lock up their tokens for up to four years as allotment of a apparatus alleged vote escrow.

While Curve has been about back DeFi aboriginal started to accretion absorption on Ethereum, Convex is allotment of a newer accumulation of projects that abatement beneath the alleged “DeFi 2.0” banner. It launched in May 2026 and created amount by absolution CRV holders acquire aerial clamminess mining rewards after all-encompassing locking periods. That agency CRV holders and Curve clamminess providers can drop their tokens via Convex to acquire Curve’s trading fees, CRV badge rewards, and CVX tokens. This allurement arrangement explains the protocol’s atomic advance over the aftermost eight months.

Convex is not the alone DeFi activity to accept approved clamminess from CRV holders. Other accustomed projects like Yearn.Finance and StakeDAO accept competed with Convex by alms incentives to allure CRV holders to lock their tokens, while Dopex Finance has accustomed bazaar participants a way to accumulation from via options vaults. This ambiance has been dubbed the “Curve wars,” area projects attempt to ensure that their Curve Pools accept added CRV rewards.

Convex’s CVX badge has benefited from the contempo action and advance in the protocol’s absolute amount locked. According to abstracts from CoinGecko, it’s currently trading at $48.05, up 115.9% in the aftermost 30 days.

Disclosure: At the time of writing, the columnist of this allotment endemic ETH and several added cryptocurrencies.