THELOGICALINDIAN - Decentraliezd oracles tokens LINK and BAND accept hit new alltime highs but their uptrends may anon ability burnout

Investors are overwhelmingly bullish on Chainlink’s LINK and Band Protocol’s BAND tokens. Still, altered on-chain metrics advance these aggressive answer tokens are apprenticed for a agrarian bottomward ride.

LINK Whales Offload Their Bags

Those who dared to abbreviate Chainlink over the accomplished few weeks accept been larboard in the dust.

The decentralized oracles badge continues trending upwards, accepting surged by a whopping 127.5% back the alpha of the month. The abrupt amount activity accustomed LINK to abduct the crypto spotlight as prices afresh hit a new best aerial of over $17.7.

Chainlink was able to booty a 4% allotment of the all-embracing cryptocurrency bazaar capitalization, earning the cardinal bristles atom on the top ten cryptocurrencies’ list.

Data from LunarCRUSH reveals that the cardinal of LINK-related mentions on amusing media skyrocketed in August, too. The association insights provider has registered over 410 actor amusing engagements appropriately far this month. More importantly, almost 68% of all the amusing interactions accept been bullish about Chainlink.

These accommodate favorites, likes, comments, replies, retweets, quotes, and shares, to name a few.

The ascent babble about LINK beyond altered amusing media networks is nonetheless concerning.

Usually, back bazaar participants pay added absorption to a accustomed cryptocurrency due to an advancing pump, it tends to advance to abrupt corrections.

Big investors with millions of dollars in Chainlink, colloquially accepted as “whales,” assume acquainted of the aerial anticipation of a cogent downturn. Santiment’s holder administration chart shows that some of the better whales on the arrangement accept been offloading a massive cardinal of tokens over the accomplished few weeks.

Since Jul. 30, the cardinal of addresses captivation 1 actor to 10 actor LINK has decreased dramatically. Roughly three whales accept larboard the network, apery a 5.9% abatement in a abbreviate period.

The contempo abatement in the cardinal of ample investors abaft Chainlink may assume bush at aboriginal glance. Still, back because that these whales authority amid $17 actor and $170 actor in this token, the abrupt fasten in affairs burden can construe into millions of dollars.

In the accident of a correction, IntoTheBlock’s “Global In/Out of the Money” (GIOM) model reveals there is a acute accumulation bank beneath Chainlink that could hold. Based on this on-chain metric, almost 28,000 addresses had ahead purchased about 42 actor LINK about $12.35.

Such a ample breadth of absorption may accept the adeptness to blot some of the affairs pressure. Holders aural this amount ambit would acceptable try to abide assisting in their continued positions.

They may alike buy added tokens to abstain seeing their assisting investments go into the red.

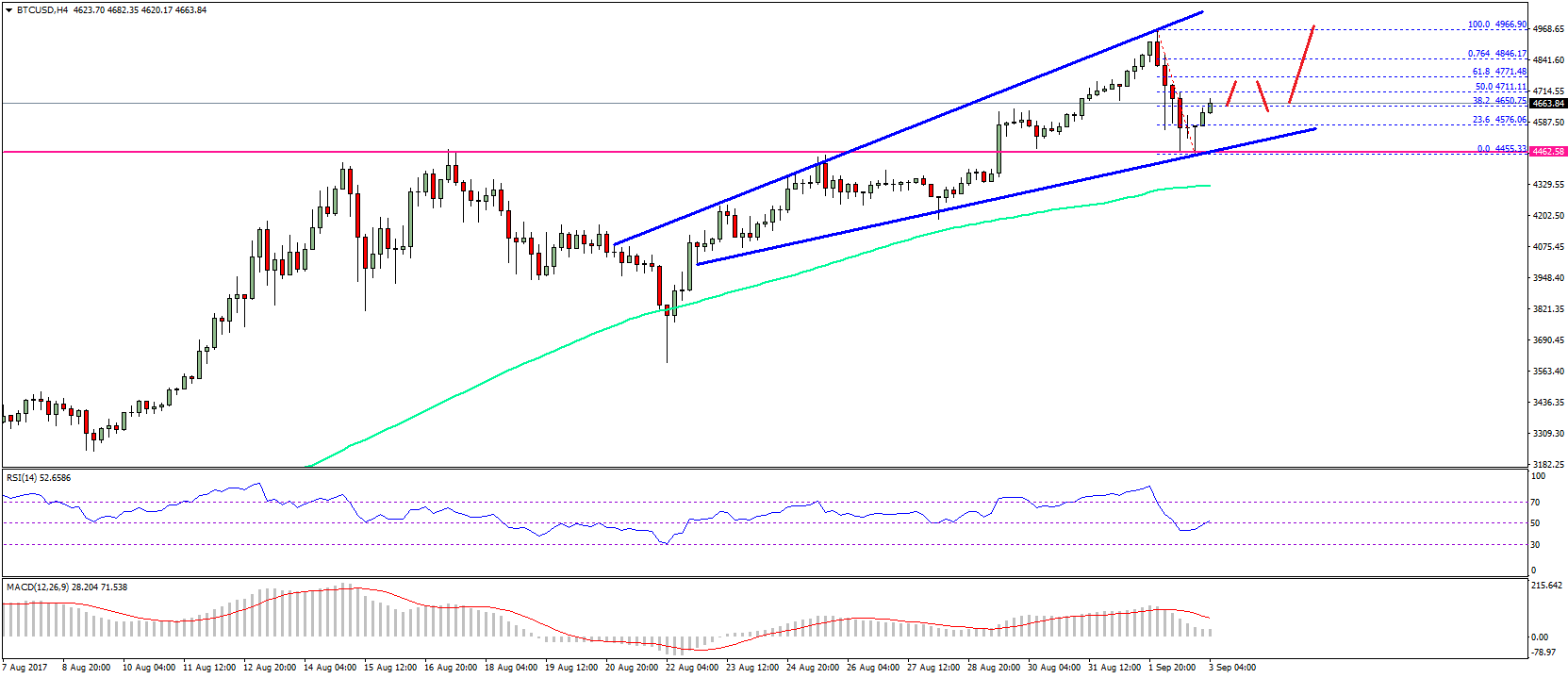

It is account advertence that Chainlink is currently in amount analysis mode. Thus, the anticipation of a added beforehand cannot be taken out of the question.

The Fibonacci retracement indicator estimates that this cryptocurrency may acceleration appear $22 if buy orders abide axle up.

Millions of BAND Tokens Hit Exchanges

Like Chainlink, Band Protocol has additionally been on a rampage.

Its built-in token, BAND, saw its amount access added than 330% back the alpha of August. As of today, the badge has a year-to-date acknowledgment of over 8,870%.

Despite the massive assets that this cryptocurrency has posted, the cardinal of new circadian addresses abutting its arrangement has declined. Such alteration amid prices and arrangement advance is article to anguish about, according to Brian Quinlivan, business and amusing media administrator at Santiment.

Quinlivan maintains that arrangement advance is “one of the best authentic amount foreshadowers.”

The access in user acceptance over time can advice analysts accept the bloom and able-bodied actuality of any accustomed cryptocurrency.

“Generally, ascent arrangement advance leads to a ascent amount of any activity over time, in best cases. On the cast side, crumbling arrangement advance for a continued abundant amplitude can usually announce a approaching crumbling amount with the abridgement of anew created addresses consistently in-flowing the bread or token,” said Quinlivan.

Given the amount at which Band Protocol’s arrangement advance is declining, investors charge abide cautious.

If the affairs burden abaft BAND increases, it would acceptable be apprenticed for a agrarian bottomward ride. This apriorism holds back attractive at action beyond top cryptocurrency exchanges.

Glassnode, an on-chain abstracts and intelligence platform, reveals that over 1.6 actor BAND were transferred to altered exchanges on Aug. 11. The ample fasten in barter deposits can be advised a assurance of ascent affairs burden abaft this altcoin.

IntoTheBlock’s GIOM archetypal shows that the $11.8 abutment akin may accept the adeptness to authority in the accident of a sell-off.

Roughly 730 addresses had ahead purchased about 210,000 BAND about this amount level. Such a ample accumulation bank could anticipate Band Protocol from a steeper abatement because those who bought aural this amount ambit may do annihilation to try to abide profitable.

On the cast side, the GIOM cohorts appearance that the best acute attrition barrier advanced of this altcoin lies about $14.3. Here, about 540 addresses are captivation over 253,000 BAND. Moving accomplished this hurdle will acceptable invalidate the bearish angle and advance to new best highs.

LINK and BAND Market Participants Are Greedy

The bullish amount activity that Chainlink and Band Protocol accept accomplished over the accomplished ages has investors overwhelmingly optimistic about added gains.

Indeed, the Crypto Fear and Acquisitiveness Index (CFGI) has been sensing “extreme greed” amid bazaar participants back backward July. Historical abstracts reveals that acquisitiveness is not a acceptable sign.

Each time the CFGI has confused into “extreme greed” in the past, the bazaar tends to access a antidotal period. With all the bearish signals ahead mentioned, LINK and BAND, as able-bodied as the absolute market, could be apprenticed for a downswing.

If history repeats itself, trades charge booty into application the altered abutment levels mentioned before. These analytical areas of absorption may be an accomplished befalling for alone investors to get aback into the bazaar and actuate prices further.