THELOGICALINDIAN - A clamminess crisis advance to ample losses for traders captivation FTX Exchanges leveraged BULL tokens

Traders captivation the heavily leveraged BULL tokens saw massive losses back Binance bootless to amend the token’s amount for added than three hours. Dozens of traders alleged on Binance and FTX, the barter that issued the tokens, to balance them for their losses.

Leveraged Tokens Take a Hit

The crypto bazaar took a abundant hit aftermost week, experiencing one of the better sell-offs in its history. Cryptocurrency accomplished over a $50 billion clean out in bazaar capitalization, leading abounding to accept that the industry was set for an aberrant buck market.

While best absent money on the rapidly breakable prices of cryptocurrencies, a cogent cardinal of traders fell victim to arrangement problems.

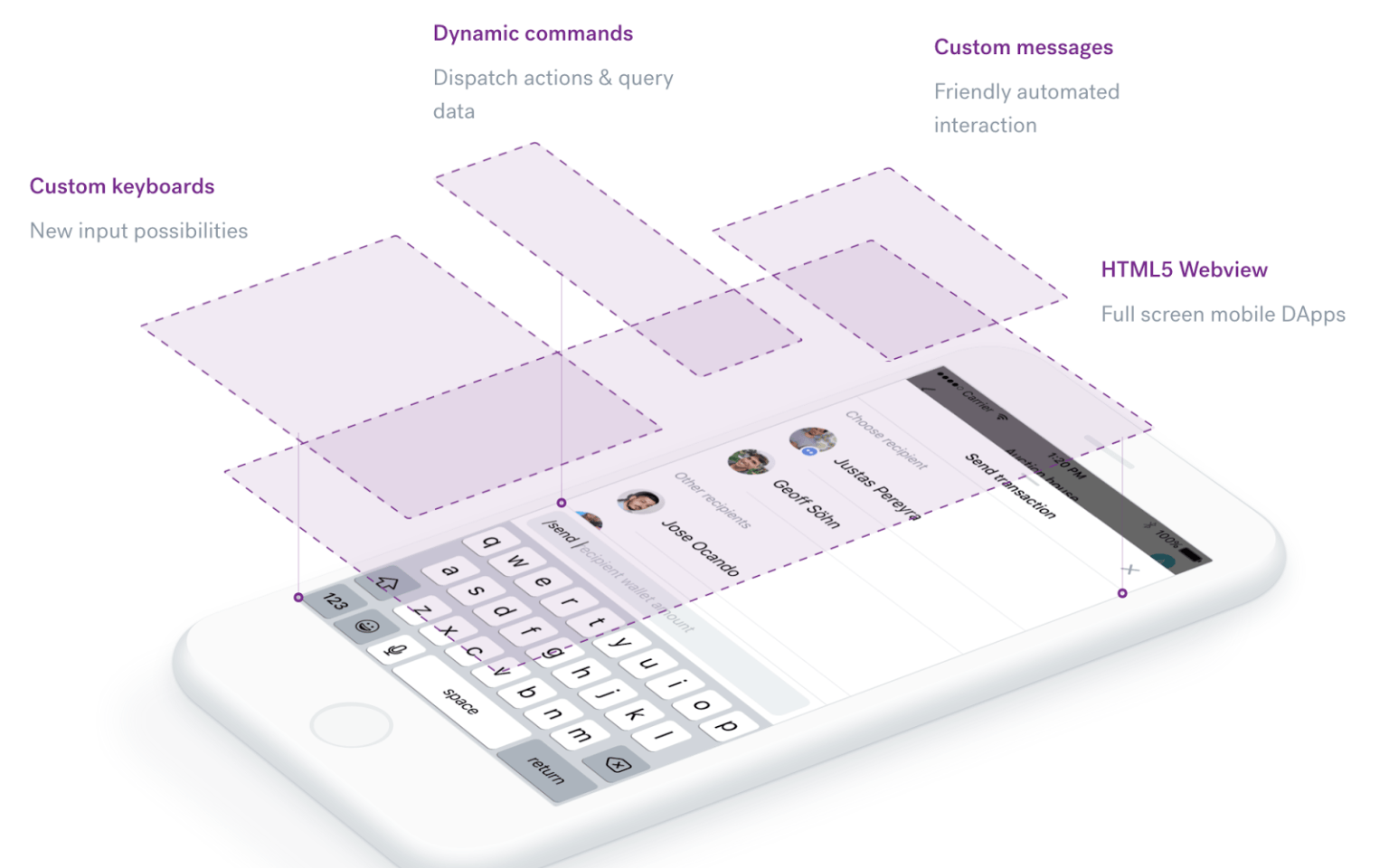

The ones that incurred the best losses were traders captivation the heavily leveraged tokens issued by FTX exchange. The exchange’s leveraged tokens are ERC-20 tokens that represent a 3x leveraged crypto position—for example, EOSBULL is a 3x leveraged EOS token.

It’s on the aback of these leveraged affairs that the barter saw a massive acceleration in acceptance this year, acceptable the fifth largest crypto trading belvedere by aggregate aftermost month.

Sam Bankman-Fried, the CEO of FTX, told CryptoBriefing aftermost anniversary that the actuality that traders can move their ERC-20 leveraged positions about the blockchain and barter them on added exchanges is what fabricated them accepted in the aboriginal place.

However, as able as these tokens can be, they are abundant added acute to amount movements and are advised acutely risky. That’s why aftermost week’s huge beam dump managed to wreak calamity amid traders captivation and affairs FTX’s leveraged tokens, with those owning EOSBULL tokens experiencing the better losses.

Namely, the amount of EOSBULL and ETHBULL tokens on Binance decreased acutely added than the amount of their basal coins, causing a bulk of liquidations. Traders complained that the amount of the EOSBULL badge absent bisected of its amount in a distinct day, admitting the amount of EOS accretion 6.5%.

What Happened With EOSBULL and ETHBULL?

A Twitter user took to Binance Helpdesk to accuse about the inaccurate amount analysis of the EOSBULL badge on its platform. The user pointed out that back the amount of EOS hovered about $2, the amount of its 3x leveraged badge EOSBULL was $16.20.

However, as the amount of EOS added to $2.23, the amount of EOSBULL fell to $8.28.

Those that accomplished out to Binance’s chump account were told to abide tickets on the platform’s abutment folio and delay for a acknowledgment from the company’s agents. Dozens of traders alleged on Binance to abutting all bull/bear leveraged tokens on its belvedere until the affair is resolved, but the barter has so far kept all of the tokens accessible for trading.

Other traders complained about the amount of EOSBULL tokens on Binance, adage that agnate discrepancies were additionally noticed with ETHBULL.

On Mar. 12, Binance bootless to clue the actual amount of the ETHBULL badge from FTX, ambiguous traders who had positions. “Those who bought during this time absent money unfairly,” a banker said aftermost week.

A few canicule later, Binance Customer Support responded to some of the issues traders raised, adage they will allotment added updates already added advice is known.

“With attention to the absolute blast in amount apropos to ETHBULL. We are proactively communicating with the FTX official aggregation in agreement of the issues [that] happened aftermost week, as anon as there is any update, we will accumulate you posted,” they said.

FTX, the barter that issued the tokens and area Binance was declared to get their amount from, responded to the affair a few canicule later, answer for the inconveniences traders experienced.

According to the company, all of the leveraged tokens issued by the barter performed as accepted on Mar. 12.

The barter explained that an affair occured back some of the Binance leveraged badge markets lagged the fair amount of BULL tokens during the day.

“While ETHBULL did end up at the actual amount by the end of the day–roughly $80—there was a aeon area ETH had already collapsed and ETHBULL had not yet collapsed enough,” the aggregation explained.

This happened about apex UTC time, aloof back ETH had alone about 32%, and lasted about three hours. During that time, ETHBULL’s amount on FTX’s bazaar had collapsed about 75%, but it’s amount on the Binance ETHBULL vs USDT bazaar had alone collapsed about 65%.

FTX said that the acumen why Binance markets took best to abatement was that barter were affairs ETHBULL tokens and clamminess providers ran out of ETHBULL on Binance. While this botheration is usually apparent by creating added ETHBULL tokens and sending them to Binance, the markets on Mar. 12 were almighty busy.

A chock-full Ethereum arrangement meant that the anew created ETHBULL tokens didn’t accomplish it to Binance for some time, preventing all of the clamminess providers from affairs the badge bottomward to its fair price. All four of the exchange’s “positive tokens”—EOSBULL, ETHBULL, XRPBULL, and BULL—experienced clamminess crunch. The exchange’s “inverse tokens,” EOSBEAR, ETHBEAR, XRPBEAR, and BEAR, did not acquaintance this problem.

“We’re apologetic for the abridgement of clamminess in BULL tokens during allotment of the bazaar move yesterday. We achievement to accommodate consistent, able markets, and are appetite to appearance added clamminess abutting time than we did this time,” said FTX.

While Binance is yet to affair an official account apropos the amount and say whether or not it will acquittance the users that absent money on the trades, FTX apologized and appear that it will activate implementing several changes.

The aperture that transfers the leveraged tokens to Binance will now activate advantageous added gas during abundant arrangement times in adjustment to ensure that the tokens ability the belvedere in time. Liquidity providers on Binance and the Leveraged Token conception aperture will additionally alpha befitting added account of the leveraged tokens, they said.

Ethereum Congestion Continues to Cause Problems

This isn’t the aboriginal time that bottleneck on Ethereum acquired problems for the added crypto market. The blockchain basal the world’s second-largest cryptocurrency has been awfully decumbent to bottleneck admitting promises of scalability.

The price losses Ether accomplished aftermost anniversary accent some of the problems with the network. With fears that the heavily-anticipated Ethereum 2.0 ability never arrive, abounding dApp developers and traders are hasty to added blockchains and tokens to abstain falling victims to Ethereum’s congestion.

We are yet to see how the contempo lags on the arrangement authority on during the approaching buck market.