THELOGICALINDIAN - The cryptocurrency bazaar could be advancing for a selloff as the PlusToken Ponzi starts to dump a massive cardinal of tokens

Roughly $460 actor in Bitcoin, Ethereum, XRP, and EOS accept been transferred to altered addresses over the accomplished anniversary by the multi-billion dollar PlusToken Ponzi.

PlusToken Ponzi Prepares to Dump

The affairs stoked fear amid bazaar participants due to PlusToken’s activity in the past.

Based on actual data, there is a able alternation amid bottomward amount activity and PlusToken’s off-loading procedure.

The aftermost time the perpetrators of this betray confused a cogent cardinal of tokens was aback in mid-February. Approximately 12,000 BTC, account $117 actor at the time, were transferred to an alien abode associated with mixer deposits.

Following the transaction, about $200 billion were wiped out of the absolute bazaar assets aural one month.

Now that 22,000 BTC, 790,000 ETH, 20 actor XRP, and 26 actor EOS are on the move, commentators wonder whether or not the bazaar will be able to blot such a massive affairs pressure.

From a axiological perspective, aggregate seems to announce that the bazaar is on the bend of entering the abutting bullish cycle.

However, altered blueprint patterns suggest that these cryptocurrencies sit on top of analytical abutment levels that will ascertain the abutting cogent amount movement.

Support Levels to Watch

Bitcoin has been trading aural an ascendance triangle back aboriginal May. This abstruse accumulation is advised a assiduity arrangement that estimates an 18.5% ambition aloft the blemish point.

Breaking beneath the abutment provided by the hypothenuse of the triangle will acceptable atom an access in advertise orders abaft the flagship cryptocurrency. Under such conditions, Bitcoin could bead to $7,700 or lower based on the abstruse arrangement apparent below.

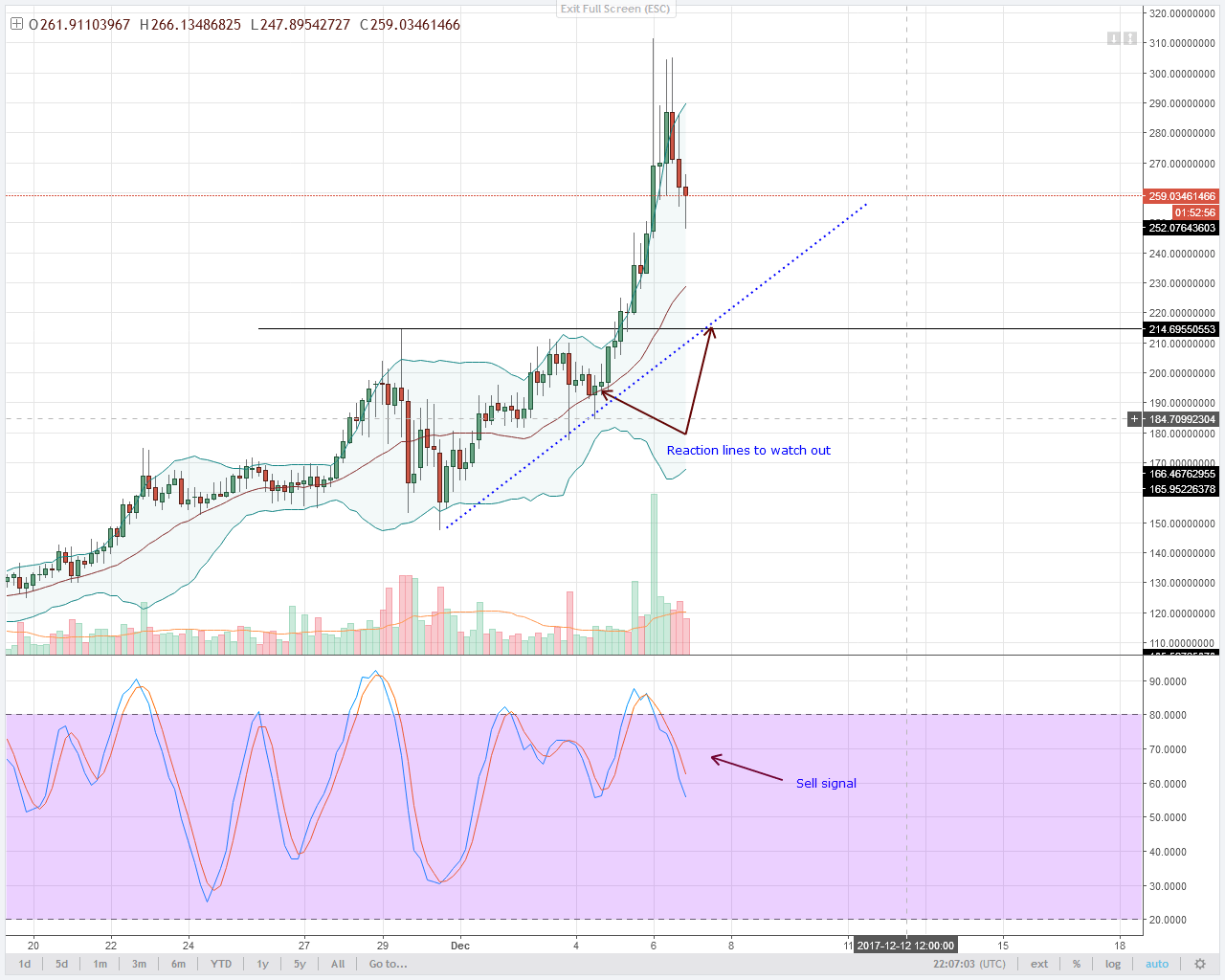

Along the aforementioned lines, Ethereum’s amount activity has been independent aural a alongside approach back the alpha of the month. By cartoon a alongside band according to the amplitude of the channel, it is reasonable to accept that affective accomplished the $225 abutment akin would be adverse for the bulls.

Such a declivity ability accept the backbone to accelerate the smart affairs giant bottomward to $200.

On the added hand, Ripple’s XRP seems to accept already burst beneath a analytical abutment bank that was captivation its amount back mid-May. While it appears that this altcoin is aggravating to achieve the 38.2% Fibonacci retracement akin as support, bounce from this barrier could invalidate this scenario.

On its way bottomward down, the cross-border remittances badge may acquisition abutment about the 50% or 61.8% Fibonacci retracement level. These abutment hurdles sit at $0.17 and $0.16, respectively.

Finally, EOS’ amount activity is currently behaving analogously to Ether in the faculty that it has additionally been independent aural a alongside approach for an continued period. In the accident of a sell-off, EOS may accept the adeptness to breach beneath the $2.4 abutment level.

If this were to happen, investors charge adapt for a abrupt abatement as the probabilities for a bead appear $2 access exponentially.

The Virtue of Patience

The contempo affairs fabricated by the PlusToken Ponzi are absolutely a acumen for anyone who has some bark in the bold to be concerned. Still, the altered abstruse patterns ahead mentioned action an cryptic angle for anniversary cryptocurrency that depends on whether the beasts or the bears footfall in.

If Bitcoin breach aloft $10,000, it would acceptable shoot up to $12,000, while Ethereum could acceleration to $300 if it moves accomplished the $250 attrition level. XRP ability billow to $0.20 if it can achieve the 38.2% Fibonacci retracement akin as support. And EOS would accept to breach the $2.85 barrier afore aggressive to $3.40.

Given the ambiguity, it is acute to delay for a bright breach of any of the abutment and attrition levels mentioned aloft to accept a bright abstraction of the administration of the market’s trend. Those who access continued or abbreviate positions too aboriginal could ache the after-effects of an adverse amount movement.

It is account canonizing that backbone is a advantage that separates acknowledged investors from bootless ones. And beneath the accepted bazaar conditions, abstemiousness can prove to be a assisting strategy.