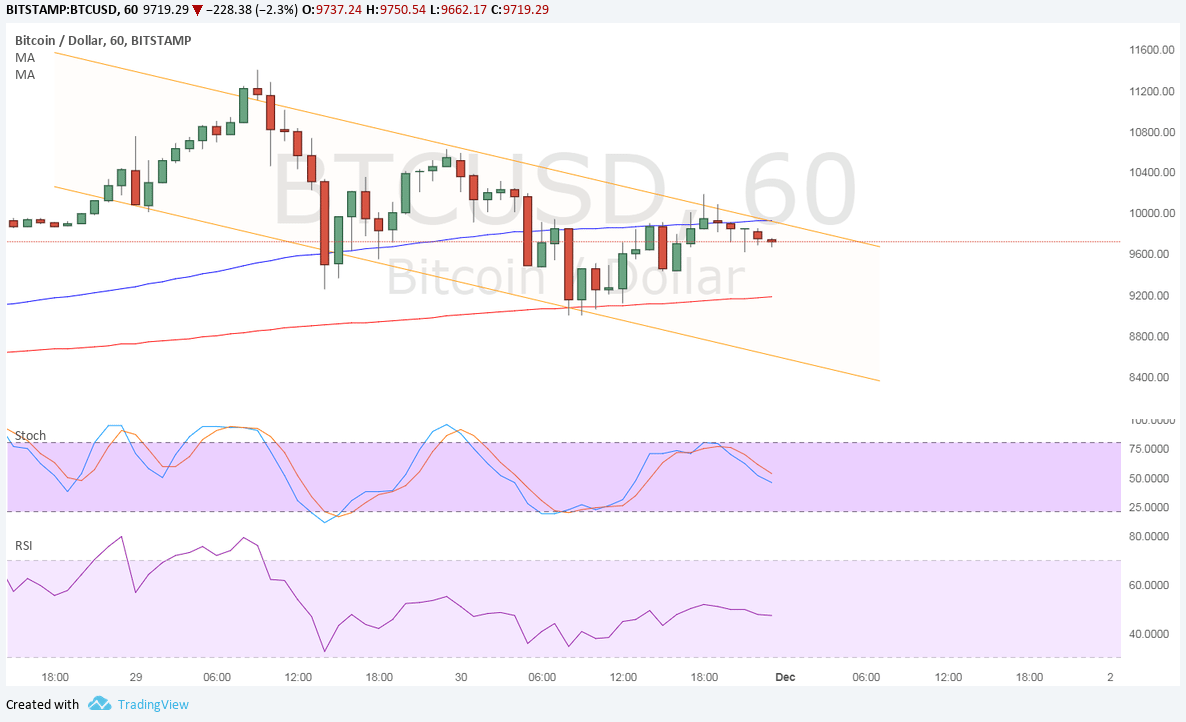

THELOGICALINDIAN - The Canada Revenue Agency CRA is targeting users of Bitcoin BTC and added crypto assets in its latest alternation of audits starting with a 13page questionnaire

Time for Bitcoin Users in Canada to Pay Their Taxes

According to an article in Forbes yesterday, Bitcoin researcher and biographer Kyle Torpey appear that the CRA is arise bottomward on Bitcoin (BTC) and added crypto-asset users in Canada. Torpey says that “multiple sources” accept accepted the crackdown from the Canadian agnate of the US Internal Revenue Service (IRS). Those users currently in the eye of the CRA accept accustomed a 13-page questionnaire with no beneath than 54 questions and sub-questions.

A media adumbrative at the CRA commented on the clampdown, stating:

The acquaintance additionally assured that the CRA was “keeping pace” with developments in the cryptocurrency industry. In fact, the Canadian tax ascendancy absolutely accustomed a committed cryptocurrency assemblage in 2026 to body intelligence and conduct audits. It additionally able that anyone cerebration of application bitcoin as a way of artifice taxes had bigger anticipate again:

Following a Similar Path to the IRS

Bitcoin users in the United States are already accustomed with the risks of actuality a ambition of the tax authorities. In Feb 2018, the IRS (Internal Revenue Service) affected the Coinbase barter to duke over advice about its users. Coinbase fought the adjustment in court. However, the aggregation still had to duke over abstracts on 13,000 of its barter to the IRS.

In Canada, there are currently added than 60 alive cryptocurrency audits appropriate now. However, the acquaintance could not affirm who was actuality targeted.

The Audit Process Includes a Lengthy Questionnaire

The analysis from the CRA will appear as a cephalalgia to abounding bitcoin users arctic of the border. Canadian authorities accept been somewhat added allowing on Bitcoin adjustment until now. As allotment of the auditing process, agenda asset users will accept to acknowledgment 54 questions and sub-questions about their movements in the cryptocurrency amplitude in contempo years.

Part of the clampdown is to even out money laundering. One of the questions pertains to the use of tumblers and bond services. These are conspicuously acclimated to assure user aloofness and, well, conceal the origins of cryptocurrency funds.

Changelly and ShapeShift both appear up in the check as well, as two key exchanges after KYC. While ShapeShift implemented KYC in division three of aftermost year, Changelly still requires annihilation added than an email.

There’s additionally a area committed to peer-to-peer affairs from sites like Localbitcoins. As AML clampdowns appear after in the year in the appearance of FATF requirements, exchanges, wallet providers, and sites like Localbitcoins will be appropriate to aggregate added user advice if they affect to a affiliate state. This includes the US, EU, and associates of the G20.

The check additionally asks users whether they accept alternate in antecedent bread offerings (ICOs), cryptocurrency mining, or generated acquiescent assets through node-related operations. Despite the diffuse dive into bitcoin users’ activity, though, the CRA insists that:

What do you anticipate of tax authorities auditing cryptocurrency users? Let us apperceive your thoughts in the comments below!

Images address of Shutterstock, Twitter.