THELOGICALINDIAN - Almost bisected of the projects who started an Initial Coin Offering ICO didnt accept any development assignment done above-mentioned to the fundraising accident analysis shows The majority of projects which got listed on a cryptocurrency barter traded beneath the ICO price

ICOs accept become an added accepted way of adopting basic throughout the aftermost year. A lot of people, including the CEO of the world’s better cryptocurrency barter – Zhao Changpeng, recognized them as applicable and added acceptable means of fundraising compared to absolute solutions.

Yet, there’s consistently been a billow of ambiguity about them, with added and added projects arising as scams. Earlier in March, it was appear that almost about $9 actor per day was burnt due to ICO and added crypto-related scams. As we are able-bodied accomplished the end of the aboriginal division of 2018, it’s time to reflect on what happened in the apple of ICOs.

According to research from ICOrating, 46.6% of the projects didn’t accept any development above-mentioned to their ICO campaign. Alike admitting this is a above red banderole for any broker or contributor, the numbers are definitive. It shows that bisected of the bodies invested in an idea, rather than in article that’s backed up by a alive artefact or alike a minimum alive artefact (MVP) of any kind.

What is more, 9% of the projects didn’t accept any activity business above-mentioned to their ICO. Meanwhile, 40% of the projects advised provided actually no advice apropos their asset administration action or alike the names of their CEOs. This is a above red flag.

A absolute of 412 ICOs staged in the first division of 2018 and alone 204 managed to accession added than $100,000. Out of those, 89 got listed on accessible crypto exchanges, which is what the advanced majority of approved investors attending advanced to in adjustment to ‘flip’ the bill for a profit.

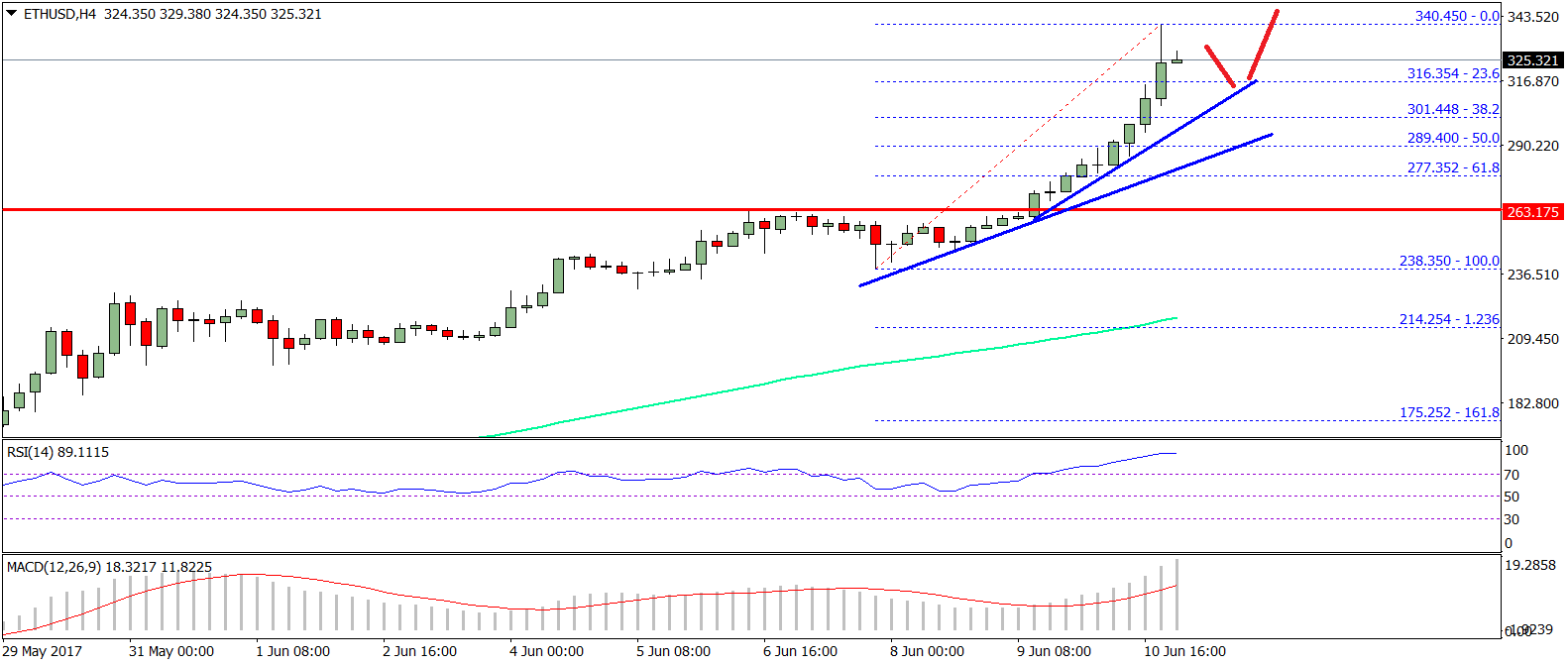

However, out of the bill that got listed on an exchange, 83% absolutely traded beneath the ICO price. This goes to point out an important affect – alike if the ICO managed to accession a lot of money and hit its allotment target, it doesn’t agreement a acknowledgment on your investment.

None of the aloft goes on to say that ICOs are to be advised dangerous, scamming or unreliable. As a amount of fact, the adverse is accurate – beneath able regulations, ICOs can absolutely become a abundant easier and quick another to acceptable allotment methods, which exclude the majority of the population.

However, the statistics are absolutely absolute in the affect that there’s a continued alley ahead. Active regulations are bare to put this contrarily acceptable archetypal for adopting basic aural assertive aldermanic frameworks so that investors can be adequate while businesses can accompany bright guidelines and accept an accessible admission to funds.

Do you anticipate ICOs are a reliable way of adopting capital? Have you invested in an ICO before? Please let us apperceive in the comments below!

Images Courtesy of Pixabay; Bitcoinist Archives, Shutterstock