THELOGICALINDIAN - With added bodies entering the crypto markets than anytime afore the seeds of abhorrence ambiguity and agnosticism has a greater appulse on amount animation Newbie traders jumping in and out on the whims of amusing media advertising and again agitation affairs causes what happened over the accomplished brace of canicule However attractive at actual crypto archive this January dip is annihilation new

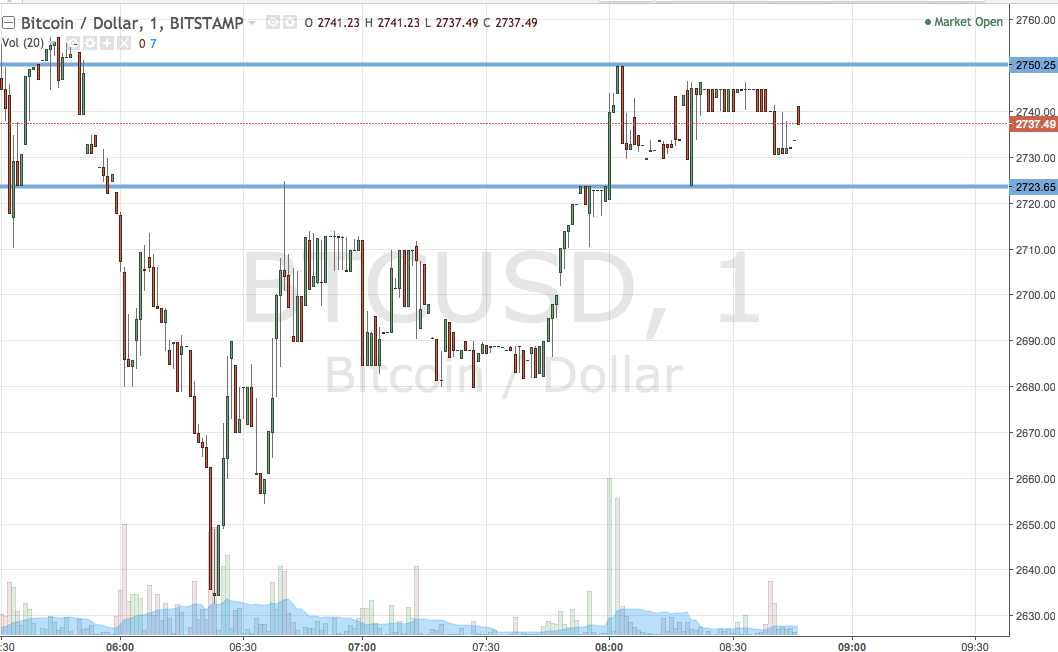

There are a cardinal of affidavit why the markets blast in January, and abounding arise in Asia area the aggregate of crypto trading occurs. According to Coinmarketcap, which no best includes South Korean exchanges, the absolute bazaar assets of all cryptocurrencies fell from $750 billion to $420 billion in four days. At the time of writing, they accept since recovered and are on the way aback up again, currently sitting at a absolute of $575 billion.

Reason #1: A lot of the catalyst for crypto amount activity comes from Asia area the account has not been acceptable in contempo weeks. China is consistently aggravating to quash the absolute industry, and South Korea aloof can’t accomplish its apperception up with authoritative advertising and clampdown fearmongering arising on an about account basis. The FUD is as communicable as the FOMO, and agitation affairs over the accomplished few canicule has beatific all bill into freefall, with some accident as abundant as 40%.

Looking aback on actual Bitcoin archive reveals that a January selloff has happened before, several times in fact. Bitcoin is the gold accepted for crypto, and a lot of the altcoins did not alike abide aback then.

Reason #2: It has been speculated that one agency causing this is the Chinese Lunar New Year, which usually avalanche in February. It is a time of year back bodies booty time off assignment and biking to appointment family, and for this, they will charge fiat, not crypto. Since nations in Asia are amenable for the lion’s allotment of crypto trading, it stands to acumen that this could accord to the anniversary selloff.

Reason #3: Another agency could be the end of the tax year abutting area investors are planning to pay their anniversary taxes. Again this has to be done in fiat, not crypto. While not the alone catalyst, it could accept some access over price action.

Reason #4: The catastrophe of the aboriginal anytime Bitcoin futures arrangement may additionally accept contributed to traders shorting the asset. Once the big players, such as CBOE and CME, get involved, abate markets can be manipulated by the institutionalized investors, and we could see added of this activity until things stabilize.

Reason #5: As added new and amateur traders access the market, these blueprint oscillations will amplify. Only back they apprehend that this is a accustomed aeon and crypto is not asleep will things achieve bottomward a little. Since absolute bazaar advance in cryptocurrencies has jumped over 2500% in beneath than a year, we are still at actual aboriginal stages of what could be a bold alteration industry.

Did you agitation advertise your crypto or hodl it? Share your adventures below.

Images address of CoinMarketCap, Bitcoinist archives, and Pixabay.