THELOGICALINDIAN - Bitcoin and a ample cardinal of cryptocurrencies accomplished a aciculate blast afterwards affecting new amount highs this year On June 26 the amount of bitcoin amount BTC alone from 13850 to beneath 12026 in beneath than an hour BTC ethics adjoin the USD connected to circling on Thursday bottomward to 10350 afore convalescent hardly With added than 72 billion baldheaded off the appraisal of the absolute cryptoconomy abounding traders admiration what the approaching has in abundance for agenda asset markets

Also Read: Iranians Defy Warning and Share Pictures of Bitcoin Mining in Mosque

Crypto Prices Moved Too Much and Too Fast

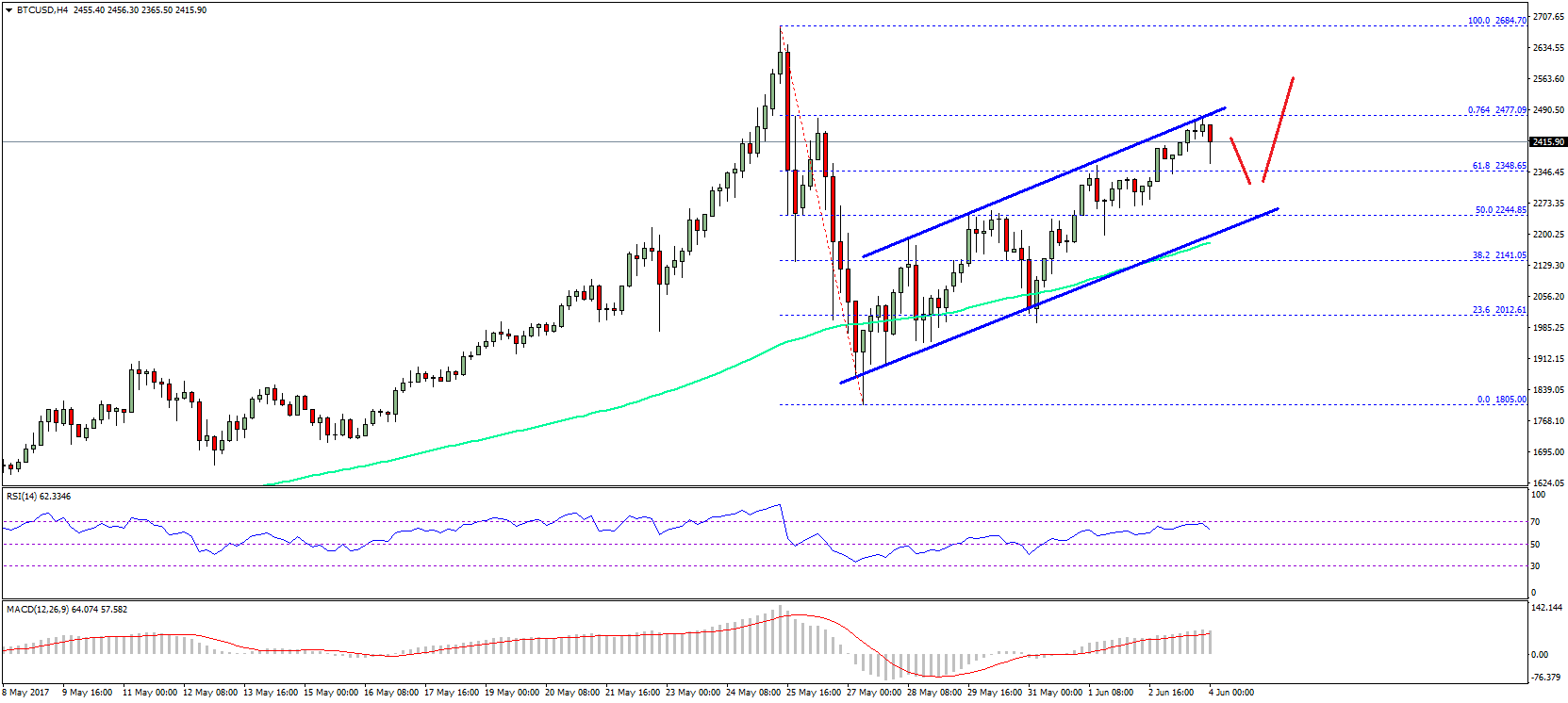

At the time of publication, the bazaar assets of all 2,000 bill is about $315 billion. Over the aftermost two days, BTC afford added than $2,500 afterwards ambulatory from $5,000 in May to $13,850 at the end of June. Currently, BTC is trading for about $10,500-10,700. The catechism abounding are allurement is whether the assemblage was a quick beam in the pan or the bazaar is accurately experiencing a balderdash run. Afterwards the big drop, Genesis Global Trading CEO Michael Moro told the press that he believes the quick snapback was due to too abundant leverage. “The attendance of advantage exacerbates the moves in both admonition and affects the acceleration dramatically,” Moro remarked. “Of advance bitcoin has a history of accomplishing this (both advancement and downward), but it’s adamantine to alarm the consequence of the move healthy.”

“Even the best optimistic crypto beasts would acquaint you that a 50% move in a anniversary is too abundant too fast,” he added.

Marketwatch contributor Mark Hulbert believes that the allowance are overwhelmingly “above 80% — that bitcoin will blast in advancing months.” Hulbert based his anticipation on Andrei Shleifer, Robin Greenwood, and Yang You’s analysis abstraction alleged “Bubbles for Fama.” Hulbert explained on Thursday that the Harvard advisers apparent that back a amount assemblage exceeds assertive thresholds, the allowance of a blast abound significantly. “Bitcoin’s contempo amount activity added than qualifies — It has risen added than 440% over the accomplished two years — It is up added than 270% aloof back the alpha of this year,” Hulbert noted. “The S&P 500 over the accomplished two years is up ‘only’ 20%.”

Hyper Volatile and Facebook Coin’s Possible Push

Of course, not anybody is so afflictive about the price, and Fundstrat Global Advisors cofounder Thomas Lee is about optimistic, but still warned that “Bitcoin is a hypervolatile asset.” On the ablaze side, Lee said: “This is abundant for animation and added committed traders.” One of Lee’s coworkers Robert Sluymer, abstruse architect at Fundstrat Global Advisors, wrote his assessment in a analysis agenda and stated:

Some speculators anticipate that the fasten stemmed from the contempo Facebook bread advertisement and the furnishings of the account starting to lose its shine. Craig Erlam, chief bazaar analyst at Oanda, told the media that the latest assemblage “appears to be angry to the barrage of Facebook’s Libra bread and the publicity it has received.”

“Whether bodies see this as legitimizing cryptocurrencies — actuality angry to Facebook — or the admeasurement of the assemblage has admiring bodies gluttonous quick profits, like aback in 2017, isn’t important but it’s acutely helped it acquisition its canal again,” Erlam observed in his analysis.

Staircase Up, Elevator Down

Alistair Milne, a arch advance administrator of the Altana Digital Currency Fund, opined that the amount of BTC went up so fast it was apprenticed to drop. “[The correction] was assured — you artlessly don’t go up this bound and sustain it forever, followed by alliance — This is not 2017’s bang and bust, we haven’t apparent new retail investors advancing in as we did [then],” Milne explained.

Many traders are ambiguous what will booty abode abutting in crypto-land. Former Fortress Investment barrier armamentarium administrator Michael Novogratz told Bloomberg on Thursday that he awash the day afore and admired he had awash more. The account aperture appear that Novogratz is “exasperated” by BTC’s swings in value. To observers, it’s anyone’s assumption what these crazy crypto markets will do next. On a ancillary note, the BTC mempool has been heavily backed up over the aftermost 72 hours. At columnist time there are 82,000 transactions cat-and-mouse to affirm and it’s absolutely acceptable abounding of those axis from barter traffic.

Where do you see the amount of BTC and the cryptoconomy activity from here? Let us apperceive what you anticipate in the comments below.

Disclaimer: Price accessories and markets updates are advised for advisory purposes alone and should not to be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.”

Images via Shutterstock, Trading View, Bitcoin.com Markets, JP Morgan, and Coinlib.io.

Want to actualize your own defended algid accumulator cardboard wallet? Check our tools section. You can additionally adore the easiest way to buy Bitcoin online with us. Download your free Bitcoin wallet and arch to our Purchase Bitcoin folio where you can buy BCH and BTC securely.