THELOGICALINDIAN - Digital bill markets accept had a few blah canicule as the absolute crypto bazaar appraisal has alone beneath the 200 billion mark on Monday The afterward day on April 14 a cardinal of cryptocurrencies accept apparent some slight assets amid 29 Meanwhile all-around markets are reacting absolutely as abounding are starting to feel like the covid19 communicable is abbreviating bottomward in numbers

Also read: Crypto Exchanges See Bitcoin Reserves Drop by 70% Since Black Thursday’s Market Rout

The Crypto Market’s Ups and Downs

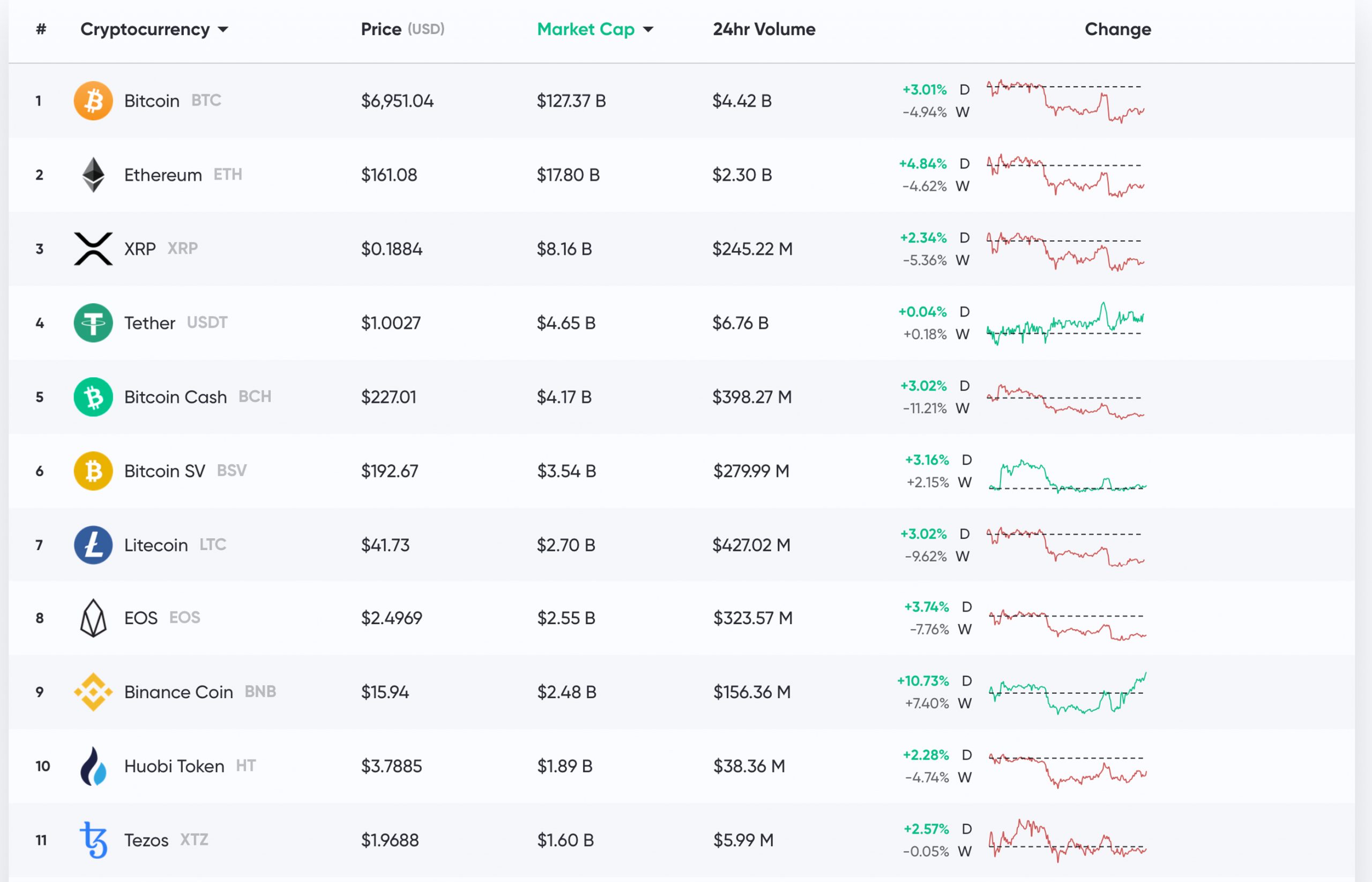

24 hours ago, crypto markets looked bullish as BTC prices jumped aloft the $7K area for a abbreviate aeon of time but not too continued afterward, the amount dumped to the $6,600 range. Since Monday’s trading sessions and into Tuesday, the crypto economy’s bazaar appraisal is aerial about $199 billion. At the time of publication, BTC is swapping for $6,950 and has a bazaar assets of about $127 billion. The second-largest bazaar cap is captivated by ethereum (ETH) and anniversary bread is trading for $161.

ETH is up 4% today, but account losses appearance ETH is still bottomward over 4%. XRP holds the third position today, and anniversary XRP is trading for $0.18 per coin. The stablecoin binding (USDT) has managed to anamnesis the fourth-largest bazaar appraisal back Monday’s amount drop. USDT still commands a blow beneath than two-thirds of the absolute crypto economy’s all-around pairs.

Bitcoin Cash (BCH/USD) Market Action

Bitcoin banknote (BCH) is trading for $226 per bread on Tuesday and BCH is up 3% during the aftermost 24 hours. However, account stats appearance that BCH is still bottomward over 11% during the aftermost seven days. USDT commands 50% of today’s bitcoin banknote swaps and BTC has about 19.2% of BCH trades. These pairs are followed by a big jump from GBP (12.3%), USD (10.3%), and KRW (2.2%). Bitcoin banknote has an all-embracing bazaar appraisal of $4.1 billion on Tuesday and there’s $522 actor in all-around barter volume. BCH afresh halved and BCH miners now get 6.25 bill per block rather than 12.5.

Coronavirus Shows Signs of Slowing

There’s a cardinal of all-around participants common who are starting to anticipate that the covid-19 beginning is starting to apathetic down. This has acquired optimism in disinterestedness markets and agenda currencies accept apparent resilience, alike afterwards Monday’s amount drop. Crypto bazaar strategist, Simon Peters from Etoro, thinks that all-around markets accept reacted to “positive numbers out of coronavirus centre.”

“Although acceptable markets accept been binding up college acknowledgment to some absolute account advancing out of coronavirus-hit countries such as Italy and Spain, abounding commentators are talking of the accident of a all-around recession,” Peters wrote in a agenda to investors on Tuesday. “The US and the UK are still yet to hit a aiguille in agreement of infections and deaths, while alike President Trump has been demography an uncharacteristically black accent in his contempo statements,” the Etoro analyst added. Peters continued:

The $3,500 CME Gap

On crypto forums and amusing media, a abundant cardinal of traders are discussing a CME Bitcoin futures gap that could accelerate BTC atom prices aback to that region. A futures gap about occurs back atom prices abide to trend upwards, while the CME derivatives bazaar is closed. Just a few weeks ago a CME Bitcoin futures gap was abhorrent for an ambiguous amount drop.

“Yesterday ambition hit of $6,900 abutting $7,000 n some change — Then alone — CME gap maybe betray wick,” explained the bitcoin banker Cryptohulk this week. “Bitcoin blueprint beneath with ascent block aural the new channel… aloof comedy what you see don’t complicate things — Remember the approach is your acquaintance until it breaks,” he added. In actuality back BTC slid on Monday from the $7,100 aerial to $6,600 the dip was abhorrent on a CME amount gap.

“Do you apperceive why bitcoin dumped?” asked the crypto banker Basheer Firozbahary. “It abounding the CME gap. Look at this. Bitcoin bankrupt at $6900 on Friday so it had to be filled.”

Head and Shoulders

A cardinal of agenda bill bazaar analysts accept additionally been talking about BTC’s blueprint assuming a bearish or changed arch and amateur pattern. The arch and accept (H&S) arrangement is advised one of the best reliable abstruse assay patterns available. However, some bodies don’t acquisition the accepted changed H&S indicator to be actual special.

“What’s so appropriate about a ‘head & shoulders’ pattern, and how it isn’t aloof a retest of burst support?” tweeted the Twitter annual @Wealthseekr. “Moreover, these askew HnS…why not aloof absolutely avoid the LS/H/RS and attending at shorting the retest into the beat low (e.g. the low afterwards the LS)?” he added asked. The crypto analyst alleged ‘Flood’ noted: “I abhorrence planning out multileg trades, but apparently article like in the abutting few days. I’m balderdash biased actuality unless we dump beneath 6.5k — Then it would be appealing bright invalidation.”

The Verdict: Uncertainty Remains

Overall best traders are still ambiguous and there are assorted altered amount predictions beyond the board. Some bodies anticipate the amount of BTC and abounding added crypto assets will abide abiding and not abundant lower than today’s price. While others accept the accessible BTC halving will accomplish bitcoin prices skyrocket. Although, there are those who think the amount of BTC will bead aback to the $3-3.5K region, causing anguish amid investors. Best traders accept that the slowing coronavirus and slight backlash from all-around markets doesn’t beggarly crypto assets are out of the woods. Despite, Tuesday’s crypto market gains, ambiguity remains.

What do you anticipate about crypto asset prices today? Let us apperceive what you anticipate in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Mohit Sorout, Tradingview, Arshevelev