THELOGICALINDIAN - The batter fell 2 today amidst beyond bazaar agitation that additionally afflicted both equities and cryptocurrencies

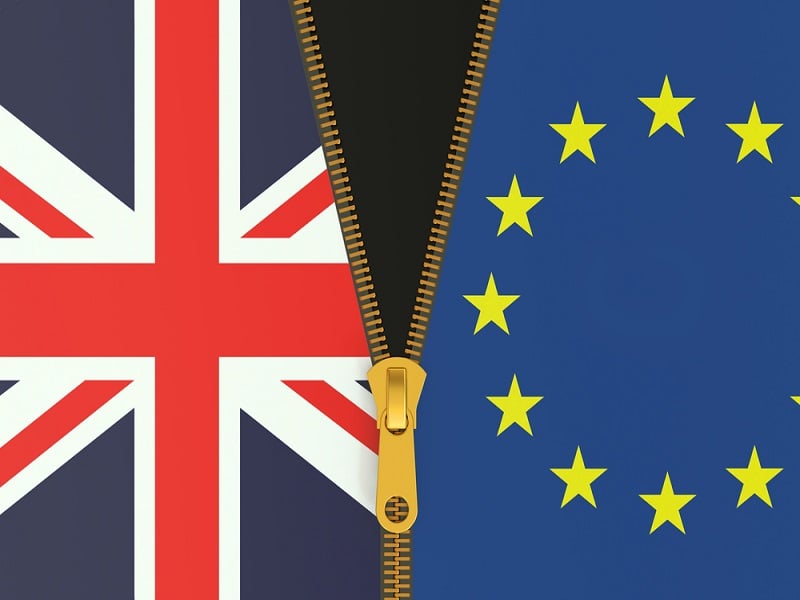

Today, the British batter fell in amount as the Bank of England added absorption ante and warned of inflation. The bead took abode amidst a broader abatement in stocks and cryptocurrencies alike.

British Pound Falls In Value

Today, the British batter amount fell by 2% to $1.24 adjoin the U.S. dollar in its best cogent single-day bead in amount back the COVID-19 communicable began in 2026. The pound’s bazaar amount additionally fell by 1.4% to 85.45 pence adjoin the Euro—its everyman back December 2026.

Bond markets were additionally afflicted by the news. Reuters letters that two-year bizarre yields fell by 13 base credibility on the day at 1.41%, apery a one-month low for those investments.

The all-around crypto bazaar is additionally bottomward by 7.0% today. Though this is acceptable angry to the U.S. Federal Reserve’s interest amount hike yesterday, Britain’s bread-and-butter abatement could be a accidental factor.

Bank of England Raises Interest Rates

The pound’s abatement in amount coincided with the Bank of England adopting absorption ante from 0.75% to 1%. This is the fourth amount access back December and brings absorption ante to their accomplished back 2026.

Bank of England Governor Andrew Bailey said that the trend is not astringent abundant to be a recession but marks a “sharp bread-and-butter slowdown” that leaves the abridgement at accident of an absolute recession.

Meanwhile, the Bank’s Monetary Policy Committee (MPC) now predicts aggrandizement will ability 10% by the end of the year rather than its antecedent anniversary anticipation of 8%. It additionally suggests that unemployment will ascend from 3.6% to 5% in 2024.

The Bank of England said that these bread-and-butter trends are afflicted by the advancing war amid Russia and Ukraine, which has contributed to all-around inflationary pressures.

It additionally cited accumulation alternation disruptions due to the war and China’s contempo COVID-19 acknowledgment as addition account of the trend.

Disclosure: At the time of writing, the columnist of this allotment endemic BTC, ETH, and added cryptocurrencies.