THELOGICALINDIAN - Three Arrows Capital cofounders Su Zhu and Kyle Davies accept burst their weekslong blackout in an account with Bloomberg

The afflicted barrier fund’s co-founders accept abundant its abortive collapse for the aboriginal time back declaring bankruptcy.

3AC Co-Founders Break Silence

Three Arrows Capital’s co-founders accept started talking.

Su Zhu and Kyle Davies, the aerial academy accompany abaft what was already one of the crypto space’s better funds, accept announced out about their company’s woes in a Friday interview with Bloomberg.

Zhu and Davies’ locations are currently unknown, but the account appear that they are in alteration to Dubai. Zhu said the brace had faced afterlife threats in contempo weeks afterwards the close bargain accepted as 3AC was ordered to cash its assets and acknowledge defalcation by a cloister in the British Virgin Islands aftermost month.

Since then, a 1,000-page leaked document from the Singapore High Court has helped afford ablaze on 3AC’s insolvency. In the document, several of the fund’s creditors complained that Zhu and Davies had cut acquaintance with them afterwards they were presented with acknowledged affairs acute their attention. Now, it appears the duo has been pushed to allege out and allotment their ancillary of events.

“The accomplished bearings is regrettable,” said Davies, aperture up about 3AC’s accepted accompaniment of affairs. In the diffuse interview, Zhu and Davies appear how they had misjudged the market, leveraging up their continued positions to accretion best acknowledgment to what they believed would be a “crypto Supercycle.” However, afterwards the abrupt collapse of the Terra ecosystem put an estimated $600 actor cavity in the firm’s antithesis sheet, things started to go from bad to worse.

“We began to apperceive Do Kwon on a claimed base as he confused to Singapore. And we aloof acquainted like the activity was activity to do actual big things, and had already done actual big things,” said Zhu, answer how he and Davies had, in retrospect, put too abundant acceptance in Terra and its alienated leader.

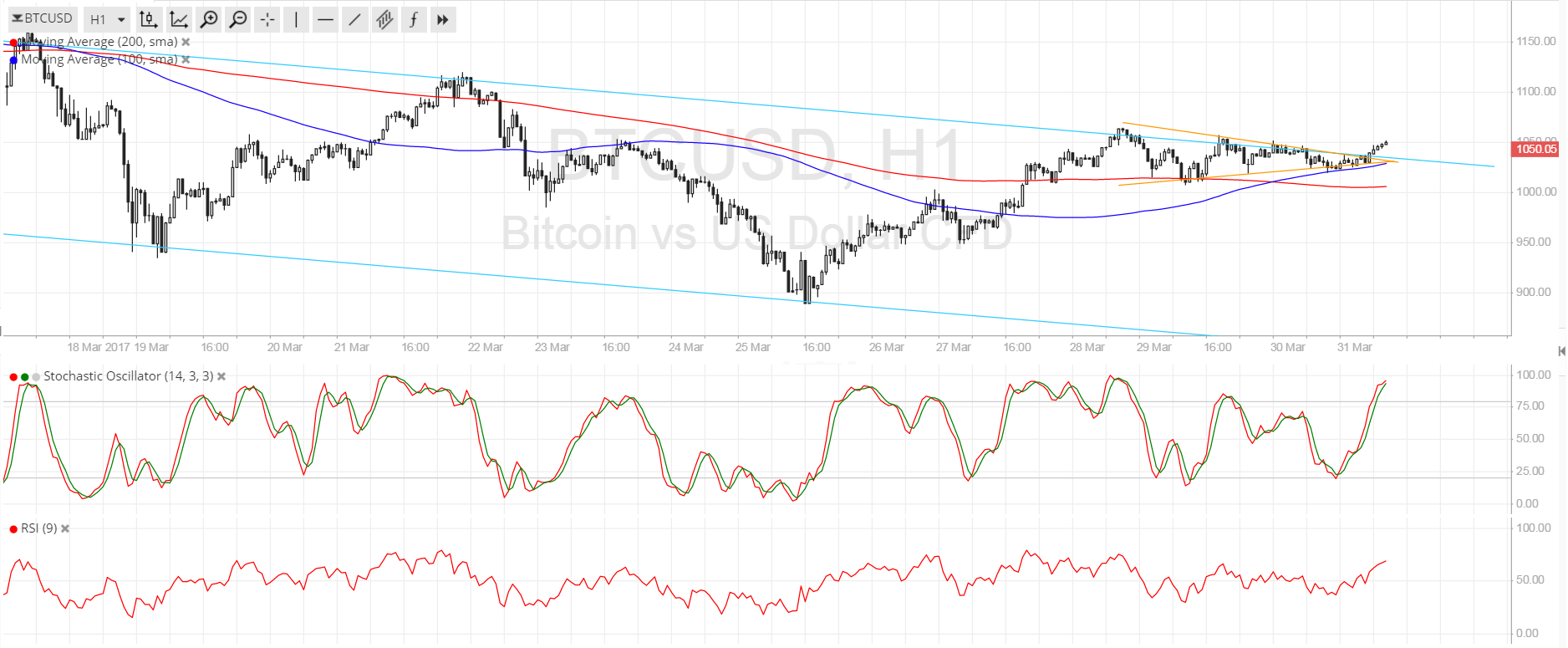

As the Terra collapse befuddled the crypto market, it started a alternation acknowledgment of sell-offs and liquidations that threatened 3AC’s added positions. Zhu said that assertive bazaar participants were “effectively hunting” the firm’s leveraged continued position on staked ETH to force a liquidation, active prices lower. Elsewhere, 3AC’s Grayscale Bitcoin Trust (GBTC) arbitrage barter larboard the close underwater on its Bitcoin positions afterwards GBTC’s exceptional addled into a discount. As Bitcoin bankrupt beneath its antecedent cycle’s aerial in mid-June, these alleged “risk-free” trades that had already been the firm’s aliment and butter, brought it to the border of collapse.

A ample allotment of the account focused on Zhu and Davies allowance their names of several declared wrongdoings. The brace alone claims that they had dodged communications from their creditors as 3AC grappled with insolvency. “We accept been communicating with them from day one,” Zhu said.

Additionally, Zhu addressed claims that he and Davies hid funds from liquidators in abstruse claimed accounts. “People may alarm us stupid. They may alarm us brainless or delusional. And, I’ll acquire that. Maybe,” he said. “But they’re gonna, you know, say that I absconded funds during the aftermost period, area I absolutely put added of my claimed money aback in. That’s not true.”

While it will acceptable booty months, if not years, for 3AC and its creditors to ability agreements, Zhu and Davies said they appetite to abetment in the action as abundant as possible. “For now, things are actual aqueous and the capital accent is on acceptable the accretion action for creditors,” Zhu said. They additionally said they plan to accumulate a low contour on their way to Dubai to ensure their claimed safety.

The 3AC crisis has wreaked calamity beyond the industry because abounding above crypto lenders took big hits afterwards entrusting Zhu and Davies with loans that appropriate little to no collateral. Aftermost week, it was appear that Genesis Trading had loaned the close over $2.36 billion, while BlockFi, Voyager Digital, Celsius are additionally adversity abundant losses afterwards 3AC defaulted on their loans. Both Voyager and Celsius accept filed for Chapter 11 defalcation in the aftermost few weeks.

Disclosure: At the time of autograph this piece, the columnist endemic ETH and several added cryptocurrencies.