THELOGICALINDIAN - Bitcoin continues on its abatement afterwards bounce at the mid breadth of its accepted levels The aboriginal crypto by bazaar cap saw a abbreviate alive assemblage on lower timeframes and has now confused aback into the lows of 40000

Related Reading | The Russia-Ukraine War Is Becoming A War On Crypto

At the time of writing, Bitcoin trades at $40,652 with a 4.7% accident in the aftermost 24 hours.

Bitcoin To See More Blood In The Short Term?

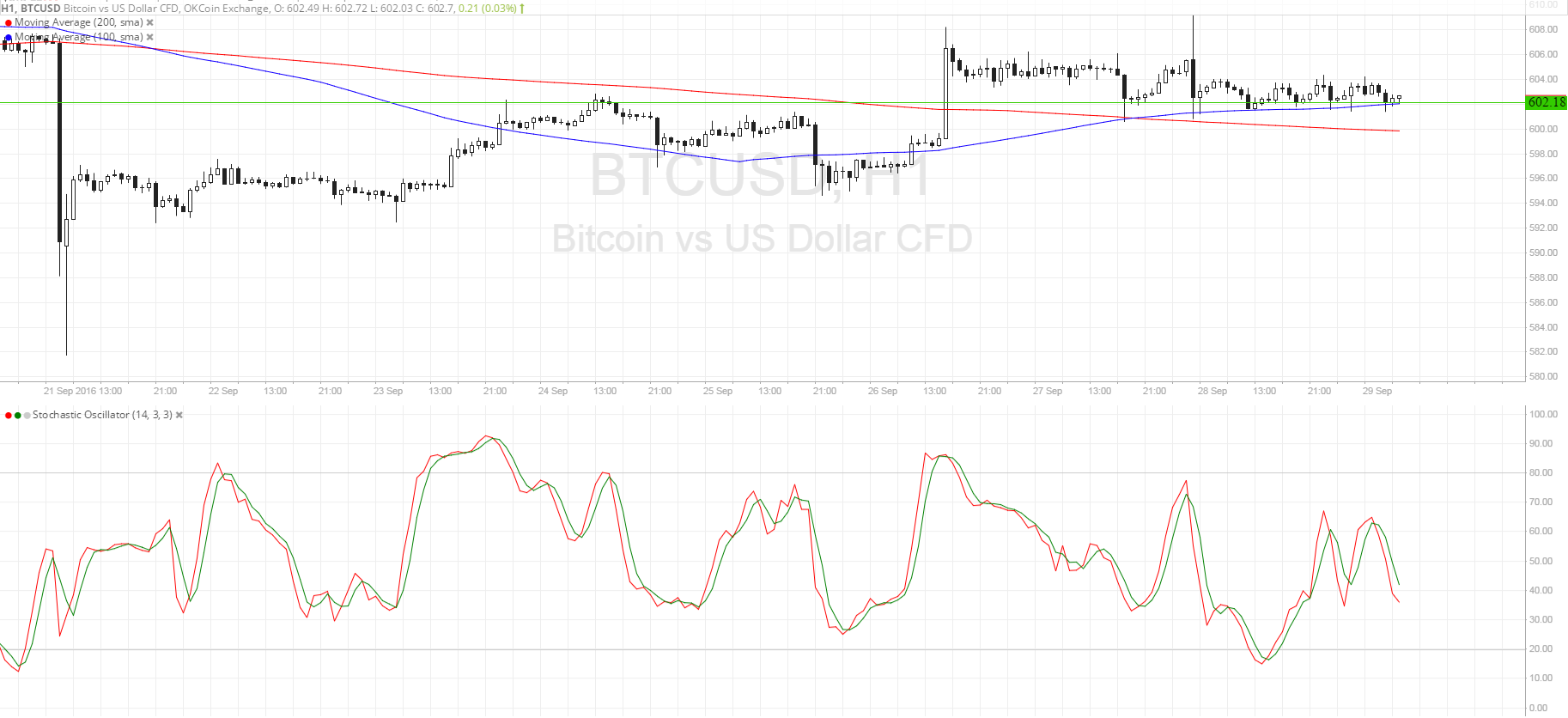

Current amount activity seems to be bedeviled by ample investors. According to Material Indicators (MI), Bitcoin has been affective into pre-rally resistance/support levels and could abide to see added losses per their Trend Precognition Indicator which signaled bearish drive on the circadian chart.

Based on this indicator and the abridgement of bid orders beneath accepted levels, MI expects a abeyant retest of lower levels. In aggregate with these factors, ample investors are “selling into the clamminess to abbreviate slippage”.

Bulls could accomplish a abrupt actualization and save Bitcoin at these levels, but added abstracts provided by Material Indicators appearance the opposite. As the amount fell beneath $41,000, at $11 actor in asks orders came at the aloft price.

If the amount is to balance to college levels, beasts charge to advance the amount aloft those orders. Material Indicators said:

How The Old World Will Push The New World To Embrace Bitcoin

Over the continued term, Senior Commodity Strategist for Bloomberg Intelligence Mike McGlone expects Bitcoin to account from macro-factors, decidedly the acceleration of deposit fuels and awkward prices.

McGlone believes the accepted fasten in the amount of these commodities, calm with the Russia-Ukraine conflict, will advance the apple to embrace new technologies and assets with anchored supplies, such as Bitcoin. McGlone wrote:

In that sense, the able believes the accepted battle amid Russia and Ukraine could mark an articulation point for BTC and a move appear it acceptable the “global agenda collateral”. The cryptocurrency could face obstacles as it keeps activated with acceptable markets.

Related Reading | Paying Netflix With Bitcoin? Here Is How It Could Happen

However, McGlone is optimistic as BTC’s amount has been assuming signs of “divergent strength” and bigger achievement than banal indexes in 2022. Over the continued run, BTC could appear out on top of abeyant downside risks in the bequest banking system.