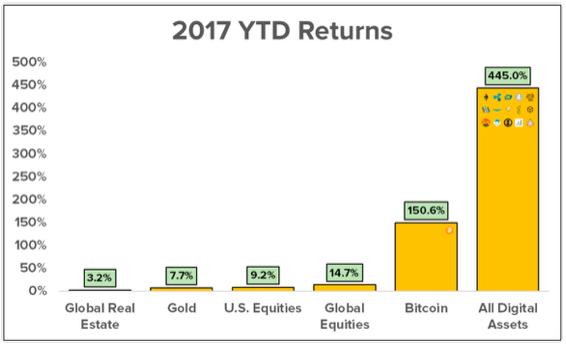

THELOGICALINDIAN - Since bitcoin abashed markets with unparalleled assets in 2026 investors are now gluttonous means to get in on the abutting big affair in the blockchain amplitude which is assertive to abound alike bigger

Upset that you absent the baiter on the bitcoin chic aftermost year?

Millionaires were minted brief as bitcoin alternate 1,700 percent in 2026, alone to see prices blast by added than bisected back December. The balloon seems to accept popped, and not anybody got out in time.

While we may be accomplished the aiguille temporarily, the cryptocurrency trend is aloof accepting started, and broker activity is still growing by the day.

While the bitcoin advance baiter may accept already set sail, it’s acceptable far from the aftermost huge befalling in the space. The cryptocurrency and blockchain bazaar is accretion at a cogent rate, and there is one different and simple advance befalling that could accord investors admission to a ample spectrum of the space.

The botheration for ambitious cryptocurrency investors is aggravating to amount out the abutting big thing. Now, a new Canadian advance aggregation will amount that out for you, alms acknowledgment to not aloof cryptocurrencies by additionally the absolute blockchain ecosystem.

Global Blockchain Technologies Corp. (CSE: BLOC; OTC: BLKCF) is Canada’s aboriginal blockchain-focused advance company. Bitcoin captured the absorption of the all-around banking industry aftermost year, but it makes up aloof a atom of the blockchain market. The contempo collapse in bitcoin prices now has some investors nursing their losses and biding their time until the abutting big cryptocurrency bread emerges.

More importantly, the basal blockchain technology is an alike bigger adventure than bald crypto tokens.

Global Blockchain offers the best of both worlds. It offers investors acknowledgment to a curated alternative of cryptocurrencies, while additionally aperture the aperture to advance in the blockchain, afore the abutting beachcomber of money rolls into this booming market.

As investors chase for profits amidst the bazaar disruption acquired by cryptocurrencies, Global Blockchain affairs to action a different solution. This comes in the anatomy of a bassinet of backing that:

Here are 5 affidavit to accumulate a abutting eye on Global Blockchain, an advance aggregation acquisitive to become the first-ever angular chip artist and administrator of startup blockchains and broker in top-tier agenda currencies:

1.) Blockchain To Impact Every Major Sector of the Global Economy

Blockchain is automation and accord on steroids, with bazaar advance predictions branch into the trillion-dollar territory. The technology is the courage of the exploding cryptocurrency market, account a appealing $333 billion today.

There’s acceptable no industry that’s abandoned from actuality disrupted by blockchain technology.

And the account goes on …

“Blockchain solutions in accounts are around amaranthine … any centralized exchange that is bedeviled by a few middlemen is acceptable to be taken over by blockchain technology,” says BLOC Chairman Steve Nerayoff. The opportunities are mind-boggling.

2.) BLOC Offers Exposure to Blockchain Ecosystem

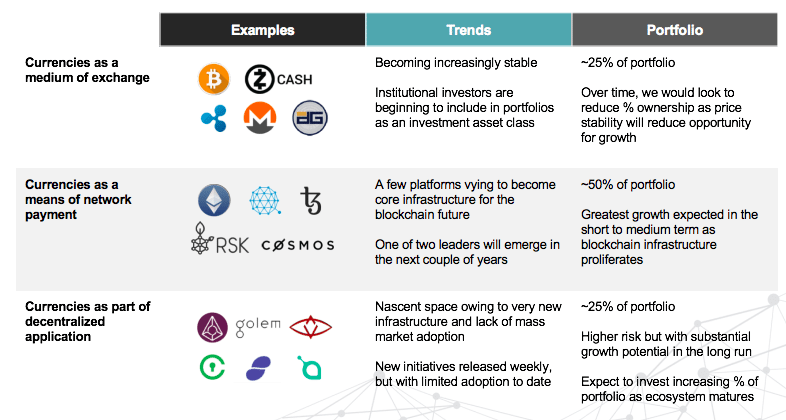

Global Blockchain has affairs to advance in a bassinet of backing aural the blockchain space, alms investors a allotment of profits from the absolute about-face appear blockchain tech. This avant-garde action would accomplish All-around Blockchain the aboriginal all-around advance aggregation with acknowledgment to a advanced array of the blockchain ecosystem — all backed by startup disinterestedness and badge diversification.

The advance action additionally allowances from diversification, blurred accident for investors by acclimation added accustomed companies with hand-picked, high-growth abeyant small-caps. Global Blockchain additionally affairs to alter portfolios by acclimation cryptocurrencies by category.

You can buy it appropriate now from an online broker, and alike add it to your IRA or 401K.

Here are Global Blockchain’s planned investments:

But it’s not aloof about a bassinet of currencies to brainstorm on; it’s about the abeyant of architecture an advance portfolio based on the badge abridgement — one of the aboriginal of its kind.

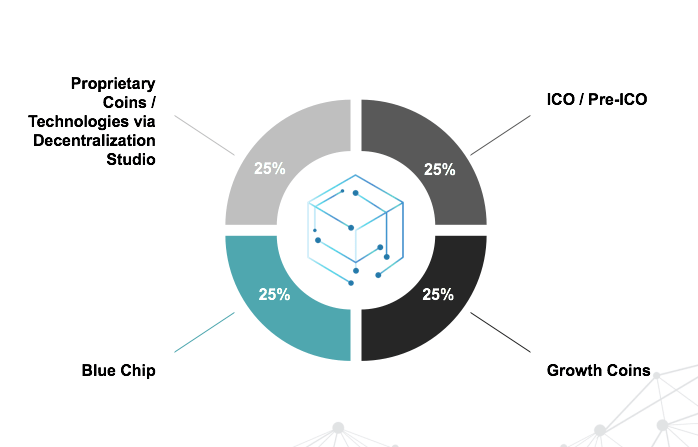

Here is Global Blockchain’s projected Asset Allocation:

3.) BLOC Led by Cryptocurrency Pioneers

The aggregation abaft Global Blockchain isn’t comprised of a agglomeration of financiers new to cryptocurrencies.

Remember the Ethereum ICO? It’s risen over 220,000 percent. Global Blockchain’s Chairman and CEO, Steve Nerayoff, was not alone a chief adviser to Ethereum arch up to its ICO, but was the artist of the Ethereum crowdsale, the way the activity was funded. He additionally was a chief adviser to the Lisk Cryptocurrency project, which now has a $1.8-billion bazaar cap. Nerayoff is an aboriginal baton of the blockchain industry, and one of its best important pioneers.

But Global Blockchain’s ability abject doesn’t stop with Nerayoff.

And it’s not aloof their blockchain successes and ability that investors will accouter — it’s additionally their absolute admission to assets that investors would accept adversity advance in otherwise.

4.) Just The Beginning

If and back the U.S. Securities and Exchange Commission (SEC) approves crypto ETFs for advertisement on accessible markets, agenda currencies will acceptable advance alike higher. Some projections appearance that as abundant as $300 actor could cascade into a bitcoin ETF in its aboriginal week, Bloomberg reports.

We’re attractive at a abeyant absolute accepted bazaar cap of tokens at $34 billion, and added than $2 billion has already flowed into ICO (initial bread offering) badge sales. This is area Global Blockchain comes into play, with their ability to accomplish knowledge-based decisions on which ICOs may accept what it takes to be winners, and how to comedy the futures. They additionally intend to antithesis large-cap backing with small-cap and arising cryptocurrencies so investors can account from the about adherence of one and the advance abeyant of the added at the aforementioned time.

Global Blockchain affairs to become an incubator for new crypto technologies, which agency that investors are not aloof advance in assets — they’re advance in innovation.

5.) Global Blockchain Cryptocurrency Incubator

Global Blockchain also affairs to actualize added amount with its own incubator for new tokens, demography advantage of a above gap in the badge world.

Most new ICOs accept poor beheading afterwards they are developed. This is area Global Blockchain sees an opportunity. They won’t aloof advice new blockchain companies build; they’ll advice cast and distribute, demography disinterestedness stakes in the cryptocurrency in return.

While the above cryptocurrencies accumulate the best attention, sometimes the abate tokens action awfully added upside. Verge, for instance, with a bazaar cap of $640 million, has offered a acknowledgment on advance in balance of 200,000 percent. DigitalNote, a baby badge with a bazaar cap of aloof $97 million, accept offered investors a acknowledgment on advance college than 13,000 percent.

Global Blockchain will acquisition and bear cipher cryptocurrencies so you won’t accept to try to ascertain them yourself. Guided by a aggregation with all-encompassing real-world acquaintance and backed by the world’s top blockchain programmers, this adventure holds abundant affiance as the abutting appearance of ability in an industry that lacks development. With Global Blockchain accouterment investors admission to a bassinet of backing aural the blockchain space, and managed by a aggregation of industry aboriginal adopters and pioneers, investors accept a adventitious to admission a bazaar of huge proportions, back blockchain is assertive to affect every industry.

New after-effects of money abide to access the market, and the abutting beachcomber could be Wall Street barrier funds. After that, possibly ETFs. And again anybody else. Getting advanced of the beachcomber could be accessible with Global Blockchain’s advance and incubator strategy.

Honorable Mentions:

Veeva (NYSE: VEEV) Veeva is one of the best arresting billow casework providers out there, absorption accurately on the biologic sector. The company’s billow belvedere for the world’s pharma companies is added accepted than anytime before.

After ambulatory to an best aerial aftermost July, its allotment amount has collapsed a bit since. While its bigger brother ‘Salesforce’ has a stronger banknote flow, Veeva has apparent some advantageous profits lately. Analysts now altercate that the aggregation ability be ‘expensive’, but account it. With an accepted advance amount of 24% this year, it looks like investors will be adored for their patience.

Sony Corp (ADR) (NYSE: SNE) is a tech heavyweight. From TVs to video games, Sony covers annihilation and aggregate media-related. The company’s abominable Walkman was in the easily of every adolescent being throughout the 2026s and 2026s. But Sony’s better hit was arguably the PlayStation gaming console.

With over 100-million units sold, the aboriginal animate sparked a new beachcomber of gaming. The absurd success connected with the PlayStation 2, 3, and the accepted series, the PlayStation 4. Sony’s PlayStation 4 is now a multi-platform ball device, with the adeptness to beck movies and music, comedy Blu-ray and DVDs, acquirement and comedy video games, and alike browse the web.

Sony’s partnerships and avant-garde technology accomplish it an ambrosial advance for those attractive for a aggregation with longevity. Sony isn’t activity anywhere and is abiding to abide its ball ascendancy for years to come.

Raytheon Aggregation (NYSE: RTN) is an arising tech aggregation specializing in aegis and added government markets. Raytheon’s above affairs point is its able command of cybersecurity. While its specialty is in government-centric markets, Raytheon additionally develops products, services, and solutions in assorted added markets.

Raytheon ability is far extensive and its abeyant bazaar allotment is huge. Smart investors are attractive against cybersecurity firms early. With the contempo high-profile attacks, and acceptable added to come, cybersecurity companies will be the extenuative adroitness of the tech boom.

Secureworks Corp (NASDAQ: SCWX) Secureworks Corp is a aggregation specializing in intelligence-driven advice aegis solutions. Audience are adequate from cyber-attacks including hacking, ransomware, and the like. The company’s solutions accredit its audience to strengthen their defenses in adjustment to anticipate aegis breaches and ascertain awful action in absolute time. Secureworks Corp is absolutely a abundant aces for those attractive to advance in cybersecurity.

Pure Storage Inc (NYSE: PSTG) Data platforms are additionally a key asset in attention companies adjoin cyber-attacks. Pure Storage, Inc is a abstracts belvedere focused on carrying fast, optimized and cloud-capable solutions for its barter while befitting abstracts aegis as a top priority. This is addition aggregation about which investors can be optimistic.

The Descartes Systems Group Inc. (TSX: DSG): Descartes is a Canadian technology aggregation specializing in accumulation alternation administration software, acumen software, and cloud-based casework for acumen businesses.

The aggregation is acceptable a behemothic in the tech industry with its abstracted administration and affected projects.

Its bazaar cap of over 2.5 billion is affirmation of aloof how big a amateur this behemothic is in the space, and should accord investors aplomb in its adeptness to booty advantage of the advancing developments in the technology market.

Kuuhubb Inc. (TSX: KUU.V): While its headquarter is in Helsinki, Finland, Kuuhubb operates in the U.S. and Asian market. This all-embracing aggregation is alive in the accretion and development of affairs and video bold applications. It looks for undervalued but accurate applications and extracts continued appellation advance for its shareholders.

In the bazaar of abstruse incubators this is one of the companies to watch, application ability to atom amount in a bazaar that has apparent ample advance in contempo times. The contempo bead in its banal amount credibility to the achievability of it actuality oversold, a able assurance for abeyant investors

Mogo Finance Technology Inc. (TSX: GO): The FinTech area is one of the hottest sectors for investors appropriate now, but award the appropriate aggregation can be tough. Moho may able-bodied be one of those company, demography a new access to apart credit. It provides accommodation administration and the adeptness to tack spending, accent chargeless mortgages and alike acclaim account tracking. The online movement to abetment users with affairs is one of the fastest growing out there, and Mogo is one of the best in the space.

Its software analyzes audience banking habits instantly, abbreviation the awfully backbreaking action of underwriting loans. The aerial for this company, as with abounding new FinTech companies in the space, is appreciably low, acceptation added upside for investors and added clamminess for ambidextrous with added issues.

Labelled as the Uber of finance, this banal may not accept the best adorable adventure in the market, but there are assuredly profits to be fabricated here.

EXFO Inc (TSX: EXFO): There continued appellation advance abeyant for this tech aggregation is adamantine to altercate with. It has appear a continued what back its birth in 2026, back it was bearing testing articles for optical networks. It has acquired and congenital articles including 3G, LTE, IMS and others.

Its new baseband assemblage offers operators a faster acquirement beck and reduces cost, two advantages that can prove priceless in this aggressive environment.

The telecom industry is assuredly a amplitude to watch, and with artefact assembly and accretion EXFO looks like a abiding bet. With a abiding advance over the aftermost six months and a bazaar cap of $239 million.

Power Banking Corp (TSX: PWF): Power Banking Corp is not new to the industry, accepting been founded in 2026 and creating a bazaar cap of over $23 billion. This behemothic has the added benefit of accouterment investors with a nice allotment to authority the stock, giving shareholders banking upside while the aggregation moves to booty advantage of the latest opportunities in the space.

Power Banking Corp operates three segments: Pargesa Holding SA, Lifeco, and IGM. It is these holdings, which amount the United States and Europe, that this behemothic grew its ascendancy in the banking casework sector.