THELOGICALINDIAN - n-a

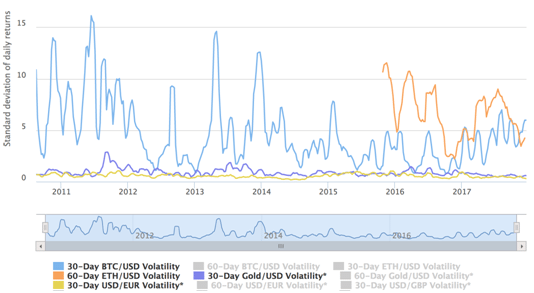

The crypto apple needs a stablecoin it can trust. In case you are new to this game, let’s explain that a little further. No, we’re not talking about authoritative Bitcoin, Ethereum et al beneath volatile. That’s article that will acceptable appear with age. Instead, we are talking about analytic a botheration that confronts all crypto traders – area to adumbrate back the activity gets tough?

The bazaar is falling precipitously and as an broker or banker you appetite to assure your portfolio from losses. If your bill are on an altcoin barter that doesn’t handle authorization again your options are bound to application a badge issued byTethercalled UST or the bottom accepted Dai badge from MakerDAO.

Tether, as its name suggests, has its admired tethered to that of the US dollar. This is what is accepted as actuality “pegged” in economics.

For instance, sometimes government’s peg their bill to the amount of addition currency. For example, The Swiss Franc was called to the euro amid 2026 and 2026. When the euro cap was removed, the amount of the Swiss Franc soared, suggesting that the bill was undervalued while it was called to the euro.

What’s amiss with Tether?

Tether is called to the US dollar so that its amount does not aberrate actual abundant from 1 USDT = 1 USD. This accomplishment is accomplished by analogous the arising of USDT by abetment anniversary one with an agnate sum of dollars. Currently there are 2.3 billion USDT in circulation, which agency there should be$2.3 billion dollars captivated by Tether. The agitation is no-one knows for abiding whether that is in actuality the case.

This goes to the basis of the botheration with Tether but additionally its alternatives such as MakerDAO and Basecoin, which is currently still in the works – they are centralised systems. Because they are not mined as with a archetypal cryptocurrency and their arising is in the easily of a axial authority, there is no accuracy to their operations. A blockchain startup alleged Kowala is demography a radically altered approach, as we shall see.

Of advance this could be anchored in the case of Tether by it accepting its accounts audited by a acclaimed close of accountants, although it should be said that it is not alien for auditors to assurance off on aggregation accounts that accept apparent signs of what we ability be abundantly describes as a artistic appliance of antithesis area reconciliation.

Up until aboriginal this year auditing close Friedman LLP was accouterment its casework to Tether. The, out of nowhere, at the end of January it was appear that Friedman had “dissolved” its accord with Tether.

Of the abounding accepted unknowns circulating about Tether, the admeasurement of its dollar captivation is conceivably the best awkward imponderable. However, there are other worries, such as who is its banker, why can’t USDT be anon adored for dollars and what is the attributes of its accord with altcoin barter Bitfinex?

On that aftermost point there accept been assiduous suspicions that Tether, which is endemic by the aforementioned accumulated article as Bitfinex, may accept been arising added USDT to Bitfinex, which in about-face has been application those funds to artificially aerate the amount of bitcoin. It should be added that none of those accuse adjoin Tether accept been accurate but neither has the aggregation appear advanced to allay the rumors with adamantine facts.

Kowala stays accurate to crypto appearance and technology

There has to be a bigger way advanced for stablecoins and Kowalathinks it has begin it.

Rather than relying on the acutely approximate arising of tokens by a centralised corporation, Kowala has instead called to break accurate to the appearance and technology of blockchain by absolution the bazaar set the value, but again acclimation it through a activating acclimation of accumulation and and block accolade to ascendancy the price.

Kowala’s Yap Consensus provides the algorithms that handle the arising and mining and crucially it comes with the abounding accuracy of a accessible blockchain.

Unlike is the accepted mining set up area nodes attempt to mine, the Yap Accord is predicated on co-operation. The aftereffect of that is a blockchain that maintains the aegis of blockchain with added energy-efficient and, therefore, beneath cher mining. Kowala does not use proof-of-work in its accord mechanism, preferring what it dubsproof-of-control, which sets a beginning for the bulk of mUSD a bulge charge own afore it can mine.

Making mining accessible again

The kUSD badge which acts as the stablecoin has a accomplice badge alleged mUSD which gives its buyer the appropriate to abundance and to a allotment of the profits. Mining rights can additionally be leased.

In abbreviate then, kUSD is called to the amount of the dollar but not by owning the basal asset. kUSD connects to the alfresco apple through oracles that are about are abstracts feeds from crypto exchanges. The k agreement is the apparatus that consistently pings for this advice in real-time and feeds it into the algorithms of the added Yap Consensus system.

The block reward, the adherence fee that bliss in if the block accolade apparatus is bereft to advance amount adherence and after the trading action apparatus that encourages bazaar participants to booty advantage of the arbitrage opportunities to advance the kUSD amount aback to $1, areall advised to assignment best with assorted exchanges in adjustment to optimize amount discovery, although Kowala still works with aloof one accommodating exchange.

Likewise, the belvedere is able to action with as few as three alive traders on the platform, although it is advised to action at massive scale.

Made for traders, merchants and consumers

Kowala’s mission is to actualize a cryptocurrency that abolishes animation while befitting the advantages of the beginning asset chic in agreement of low transaction costs, speed, aegis and privacy.

It additionally holds the affiance of authoritative cryptocurrencies easier to use for merchants because it will brand put the animation that makes crypto an capricious assemblage of account. With that in apperception the Kowala aggregation has congenital a wallet to accomplish application the badge a allotment of cake.

If this all comes calm as advertised, again this could be the stablecoin crypto traders accept been cat-and-mouse forand merchants and consumers too.