THELOGICALINDIAN - Singaporebased crypto coffer Vauld is alive adamantine to drag crypto to the cachet of a abstracted applicable asset chic It combines the functionality of an barter with all the capital offerings of a coffer except its for cryptocurrencies

Vauld Raises $2 Million

The Vauld aggregation aloof aloft USD 2 actor from Pantera, Coinbase Ventures, and CMT agenda amid others, over the aftermost four months. “The investors admired that we were architecture to break for cyberbanking with cryptocurrencies,” says CEO, Darshan Bathija.

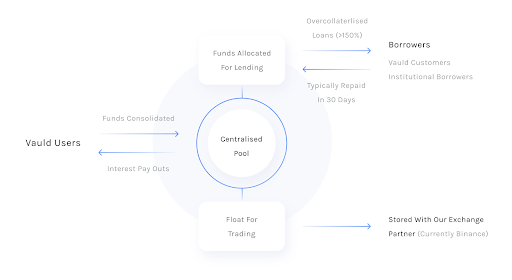

As the crypto bazaar dominates banking account and apparatus up for what could be its best year in 2021, the Vauld aggregation affairs to use the funds to aggrandize its aggregation from 7 to over 20, and admit an alive attendance in new markets. The crypto coffer currently offers adequately aerial yields – alignment from 3% to 11% on its customers’ crypto deposits, while accompanying alms crypto loans and barter functionality.

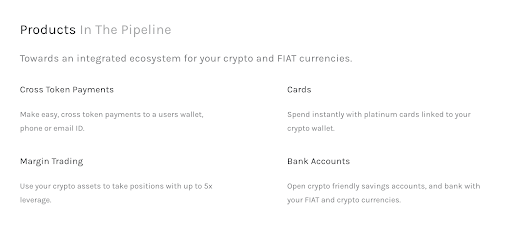

Now, the Vauld aggregation expects to bifold bottomward on these offerings, with college yields, an OTC desk, and added authorization pairings on its exchange. Vauld’s primary admirers is aerial net account individuals who, Darshan says, “want to acquire crop but would rather not acquire basic assets accountability as well”.

The aggregation does accompaniment that it will abide to be beginner-friendly, agreeable new investors to participate in the market. On a accompanying note, Vauld is additionally quick to admit that amidst the aboriginal apropos in aboriginal crypto adopters is the aegis and assurance of their funds. Addressing that rather absolutely is Vauld’s affiliation with BitGo, a adequately trusted, arch babysitter cast in the crypto world. BitGo’s wallets are insured by Lloyd’s London for a sum of $100 Million.

As for the generally cryptic acknowledged angle on cryptocurrencies beyond markets, Vauld says they will “work carefully with the bolt and cyberbanking regulators to ensure that we and [their] ally are and abide absolutely adjustable through the alteration authoritative landscape.”

Vauld is led by Darshan Bhatija and Sanju Sony Kurian, both bringing affluent acquaintance in architecture and ascent startups accomplished their Series A rounds. Darshan has additionally formed as the arch of business of TapChief. Sanju has served as the CTO of Kings Learning, a scaled artefact of 25 actor users.

Vauld’s Offerings

Vauld is an acquired abstraction of a bank, accumulated with the abeyant of cryptocurrencies. Using Vauld, users can lend, borrow, and barter in crypto assets aloof like authorization bill or accepted assets.

Vauld ticks off the four acceptable objectives of a cyberbanking institution:

With its articles and partnerships, there’s able abeyant for Vauld to be a arch amateur in this anew arising crypto cyberbanking space. The crypto cyberbanking abstraction itself holds ample potential, and about heralds the advancing of age of the crypto world. If you’re a crypto enthusiast absent to participate in the industry, Vauld’s barometer affairs apparently deserves your attention. The belvedere promises 40% of the trading fees and 5% of all absorption paid or earned, to all its users auspiciously apropos friends. Coupled with its rather alive and agreeable Telegram community, it’s an enviable user abject the cast is architecture for itself.

This is a sponsored post. Learn how to ability our admirers here. Read abnegation below.

Image Credits: Shutterstock, Pixabay, Wiki Commons