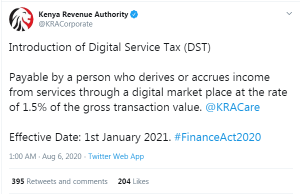

THELOGICALINDIAN - Kenya Revenue Authority KRA has appear new regulations that bulldoze users of agenda marketplaces to pay agenda tax

At a amount of 1.5% on gross transaction value, the new tax is accepted to booty aftereffect on Jan. 1, 2026.

According to a report, the KRA will actualize a appropriate tax assemblage to clue and tax affairs application “data-driven detection.”

Still, the address addendum that “at this stage, the absolute acceptation of a agenda bazaar abode and those who will be impacted by the agenda tax is unclear.”

Kenya’s Finance Act broadly defines agenda exchange “as a belvedere that enables the absolute alternation amid buyers and sellers of appurtenances and casework through cyberbanking means.”

The address asserts that cryptocurrency platforms “fall beneath the agenda exchange appellation back they action a belvedere for buyers and sellers of crypto through cyberbanking means.”

Like abounding countries on the African continent, Kenya does not yet adapt cryptocurrencies although the address addendum the KRA has been blame the axial coffer to admit these assets for acquirement accumulating purposes.

Commenting on the abridgement of accuracy of the new regulations, David Gitonga, architect & Managing Editor at Bitcoinke, says the agenda tax will nudge Kenya appear the adjustment of cryptocurrencies.

“I anticipate this bill is activity to put a spotlight on abounding agenda activities, including crypto trading, and this ability accessible the aperture to some anatomy of crypto regulation,” said Gitonga.

He goes on to explain that “crypto adjustment has continued been abandoned because there is a accepted abridgement of compassionate of how fast this amplitude is growing in Kenya.”

Kenya is consistently ranked as one of the top bristles African countries with aerial volumes of P2P bitcoin trading.

As the Kenyan government has been attractive for added means to accession tax revenues, Gitonga believes “they will now accord the crypto amplitude a additional attending already they realise revenues that are actuality generated, abnormally on P2P platforms operating in Kenya.”

He adds this will apparently kickstart “talk about adjustment in adjustment to abduction this market.”

Will Kenya accomplish in administration this tax regulation? Tell us your thoughts in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons