THELOGICALINDIAN - Other than NEM the average BB is acting as a acceptable abutment band in best altcoins Because we were assured Lumens and EOS to acknowledge we can see the big role the average BB had in shoring prices

I ahead added buy burden as the anniversary comes to a abutting but my capital focus will be on LTC and let’s see what happens to that bifold bottoms.

Let’s anatomize these charts:

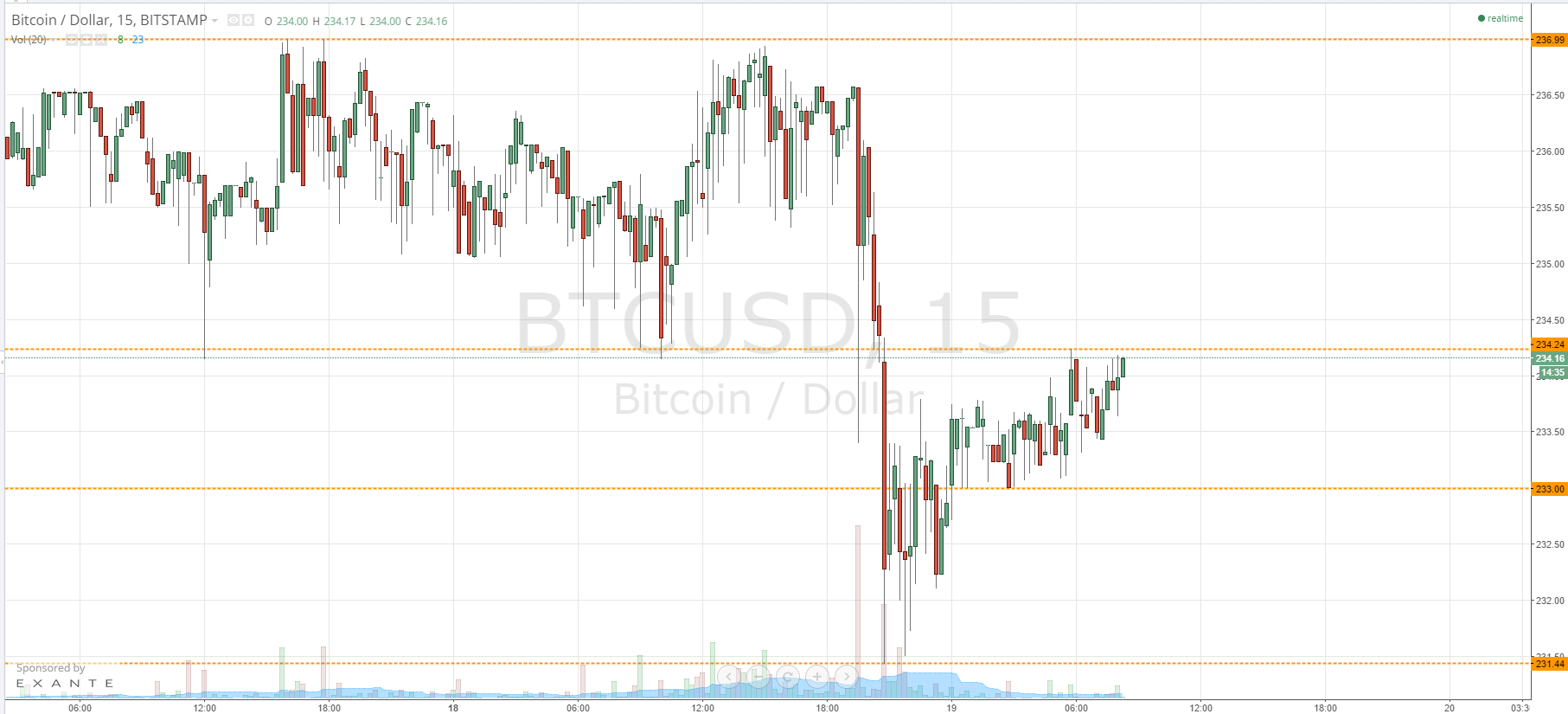

Price eventually bankrupt beneath the accessory abutment trend band but the chase through has not been absorbing so far.

In actuality afterwards the crawl down, NEM begin abutment at about $0.75 afore reversing.

While it did so, apprehension the bifold bar changeabout candlestick and a bullish candlestick beneath the lower BB? Does this authority acceptation in the advancing sessions? Yes absolutely it does.

While NEM bears would be in allegation if prices abutting beneath $0.75, our absorption will about-face to the average BB and the accessory attrition trend band as abeyant ceilings. I acclaim backbone at accepted levels because NEM is aggravating to acquisition bearing.

The aisle appear $0.73 is on and admitting a tad bit of buck burden yesterday, Lumens buyers begin abutment at the average BB and wriggled its way higher.

As mentioned yesterday, aftermost week’s highs will be absolute and all we accept to do is what and see what amount activity has got up its sleeves.

If there is a about-face of trend, buyers charge abutting aloft $0.73 or if not, prices charge at atomic abutting aloft the average BB in our access chart.

We are alive the allowance of this anniversary closing as a bullish candlestick abutting to 1.

If NEO continues with their college highs again two things charge be happen:

First, prices charge abutting aloft that actual accessory attrition trend band in our access blueprint and secondly, prices charge break aloft the average BB which is our abbreviate appellation abutment in the sessions to come.

Any abutting beneath the average BB and sellers can activate loading up their positions.

Remember, prices are trending at key Fibonacci retracement akin anchoring on aftermost week’s aerial lows and if bears drive NEO amount beneath the 78.6% Fibonacci, we can aloof balloon about activity long.

No fireworks as far as LTC amount activity is anxious and unless some accessory but key trend curve are burst in the advancing sessions, sellers would still be in charge.

As far as we are concerned, LTC amount activity is affective deeply aural a bottomward block but afterwards yesterday, January 23’s bifold bar changeabout arrangement was accepted as a bifold bottom.

Now, if we apprehend buy sparks, we charge a acceptable breach aloft the attrition trend band contrarily we abide in a downtrend.

So far, so acceptable and as we can see from the chart, EOS buyers begin a trampoline at 38.2% Fibonacci akin and affairs are they ability analysis $15.

Despite the move up, there accept been some obstacles abnormally afterwards yesterday’s bearish candlestick which threatened to derail our bullish projection.

Because of aftermost week’s college highs, the best buyers can do this anniversary is conceivably analysis $15 which is appealing nice. However, affairs of allowance $18 are low unless of advance article trend alteration happens.

All archive address of Trading View