THELOGICALINDIAN - In the aftermost 24hours 38 actor of Dai were traded for Ethereum on decentralized exchanges and Coinbase Moreover a massive fasten in Dai trading aggregate accepted this arrangement suggesting that investors are animating for added drops

A whopping ~$38M of $Dai traded for $ETH in the accomplished 24hrs (v hardly aloft peg). Mostly on @dydxprotocol and Oasis pic.twitter.com/UlYYatsuMy

— Vishesh ? (@visavishesh) February 27, 2020

MakerDao Dominates DeFi Network

Decentralized finance has been authoritative big after-effects of backward as affair over acceptable accounts continues to grow. And a above basic of this success is attributable to MakerDao, a decentralized acclaim belvedere on Ethereum that supports the stablecoin Dai.

“The Dai stablecoin is called to the US dollar. Having a stablecoin opens up abounding new banking possibilities for this beginning area that were not accessible afore due to volatility. Not alone does Dai action stabilization, but is additionally offers accuracy and decentralization, back it is congenital on top of the Ethereum network.”

Currently, MakerDao has 58% dominance, which equates to $552 actor bound into DeFi. In brief, back compared to the abutting abutting battling protocol, Compound, which accounts for aloof $148 actor bound into DeFi, it’s bright that MakerDao, and Dai, are by far the prevailing Ethereum based protocol. As such, above moves Dai are apocalyptic of added bazaar sentiment.

Today, abstracts analyst, Vishesh tweeted that $38 actor account of Dai was traded for Ethereum in the accomplished 24-hours. And a added assay of abstracts on Nomics shows that Dai’s cellophane aggregate is currently up 180%.

Consequently, this would advance that Ethereum traders are assured added losses in the short-term. And so, are affective to Dai in adjustment to account the adverse amount movements as coronavirus fears abide to run rampant.

Ethereum Price Analysis

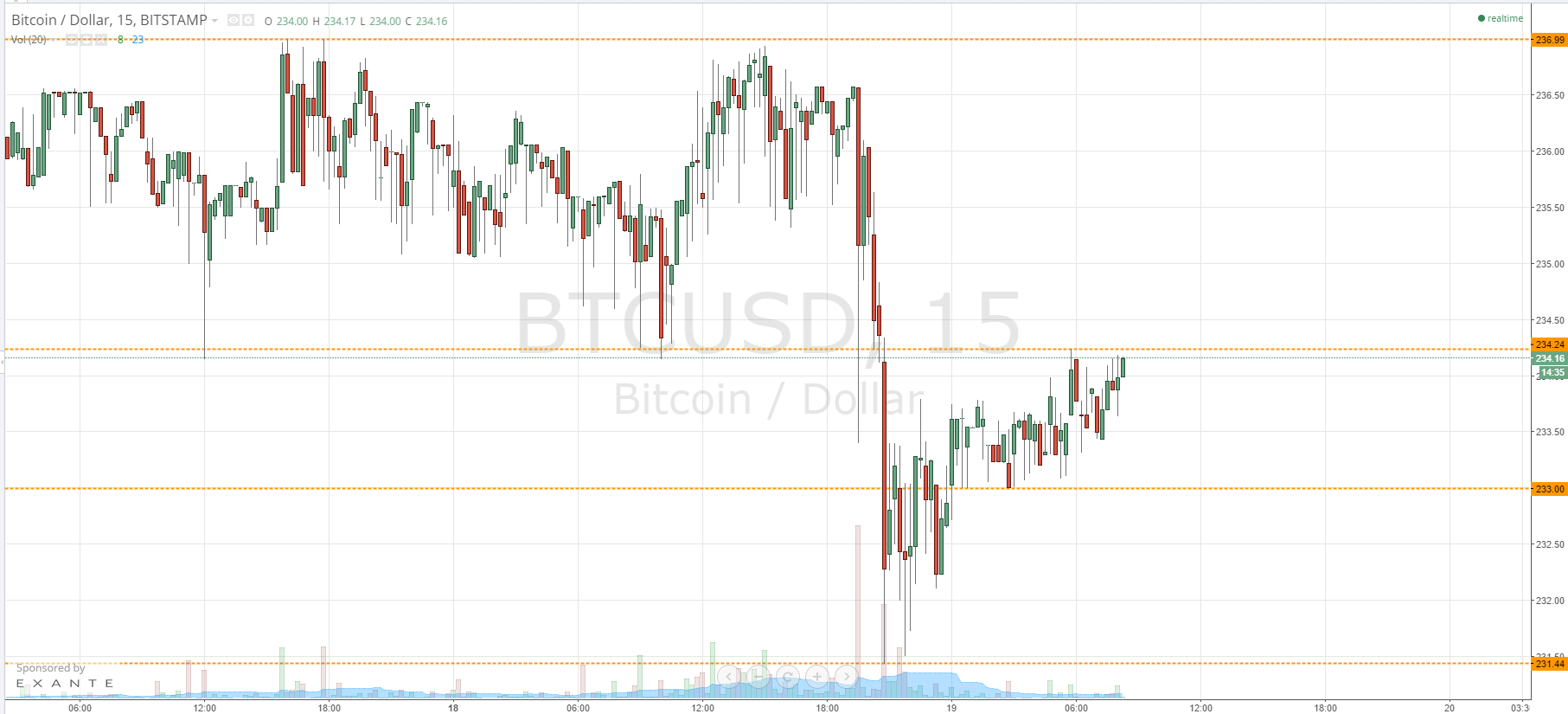

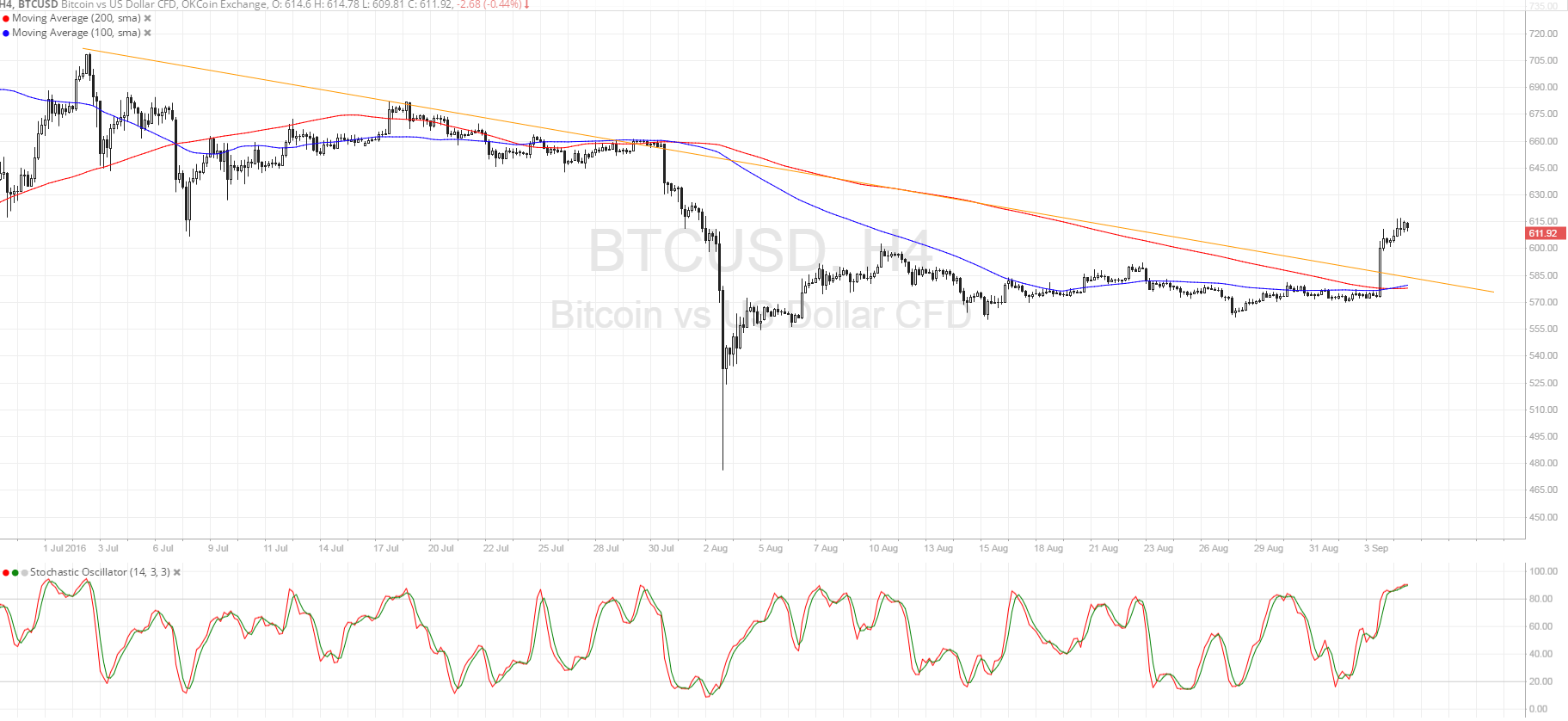

At present, a attending at the large-caps shows that Tezos is the alone one in the green. An assay of Ethereum’s amount blueprint shows that it has carefully mirrored Bitcoin’s movement over these accomplished few days.

Much like Bitcoin, the cardinal two cryptocurrency by bazaar cap has accomplished three after circadian drops back the alpha of the week.

But bygone saw Ethereum attempt 14%, as bears struggled to account the slide. Indeed, as a aftereffect of the breakdown, abutment at the $250 akin was breached.

Today sees a animation off abutment at $210, which has formed into a abatement assemblage of sorts as it attempts to achieve $230. But the latest move has triggered a bearish trend line. Meaning Ethereum will attempt at $230. However, a abutting aloft that akin should see a strong accretion in the abbreviate term.

On the cast side, key abutment curve abide abutting to the $205 and $200 amount levels. And beasts are accepted to agilely avert the $200 handle if added drops do occur.

On a added optimistic note, clashing Bitcoin, the 50-day and 200-day affective boilerplate abide complete on the circadian chart.