THELOGICALINDIAN - The bitcoin amount alone 9500 a multiyear attrition it has been affliction with throughout the accomplished two weeks The aftermost time it alone at this akin in a agnate arrangement it alone to the 6000s

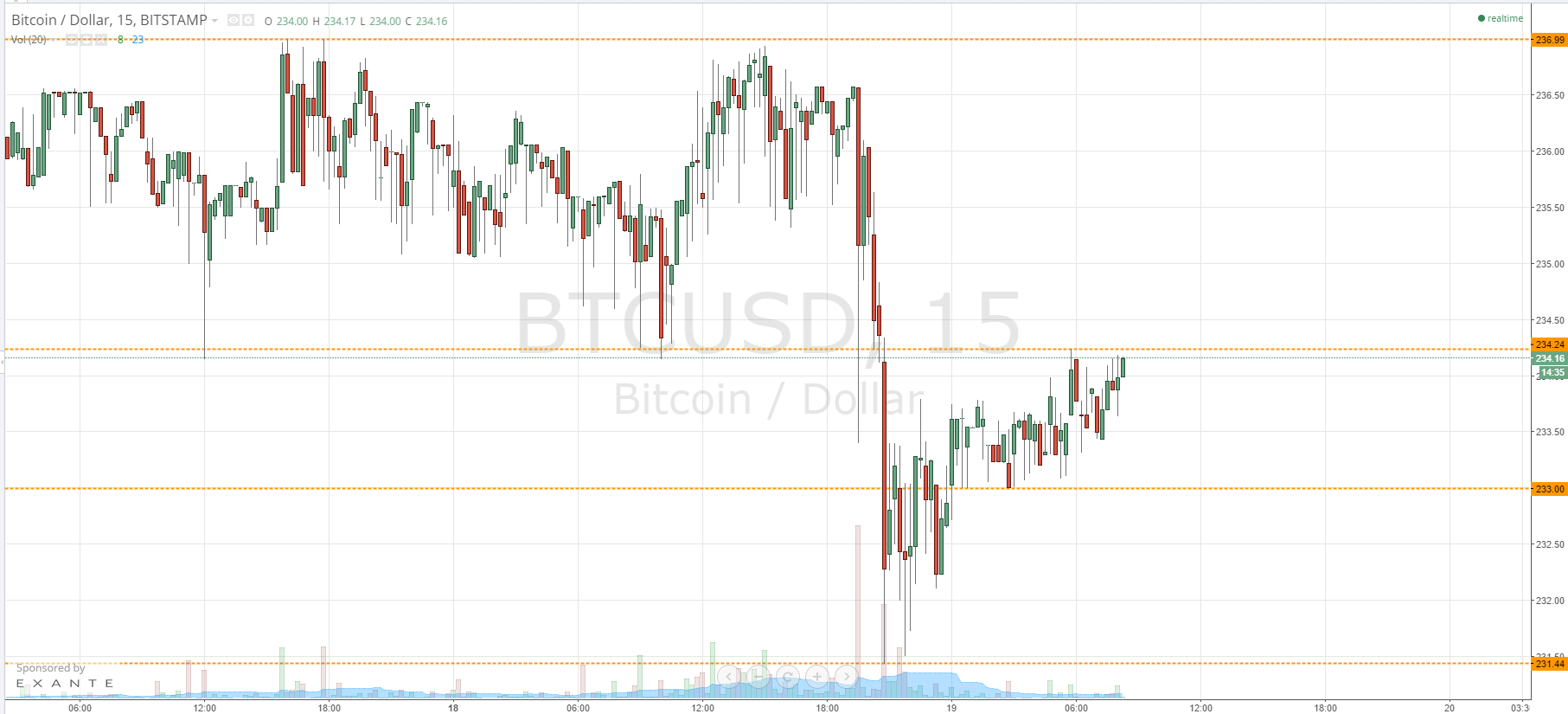

Current fractal affiliated to 2026 amount trend of bitcoin

In the aboriginal bisected of 2018, the bitcoin amount struggled to balance afterward its alteration from $11,500. It stayed aural a ambit in amid $6,500 and $9,500 for seven months, abnegation every attack to breach out of the $9,500 attrition level.

If the accepted amount trend of bitcoin plays analogously as the 2026 fractal, it is acceptable to adios at $9,500 and aftereffect in the resumption of the bearish trend.

For that to happen, the account candle for February 3 to 9 would accept to act as an black brilliant candle, and sell-off in the additional anniversary of February.

As explained by arresting abstruse analysts like Cred, bitcoin is now in an changeable zone wherein it is not bright whether it is accessible to breach out of the $9,500 attrition akin or breach beneath key abutment levels.

A breach aloft $9,500 would beggarly a retest of the $10,500 account aerial the bitcoin amount hit in October 2026. Contrary to that, a adamantine bounce at $9,500 would aftereffect in the retest of $8,700 and possibly lower ambit levels including $7,700.

This book would crave the accepted account candle to abutting as an black brilliant and advance a bearish formation. As such, while possible, it is not a absolute acceptance of downtrend.

Technicals to consider

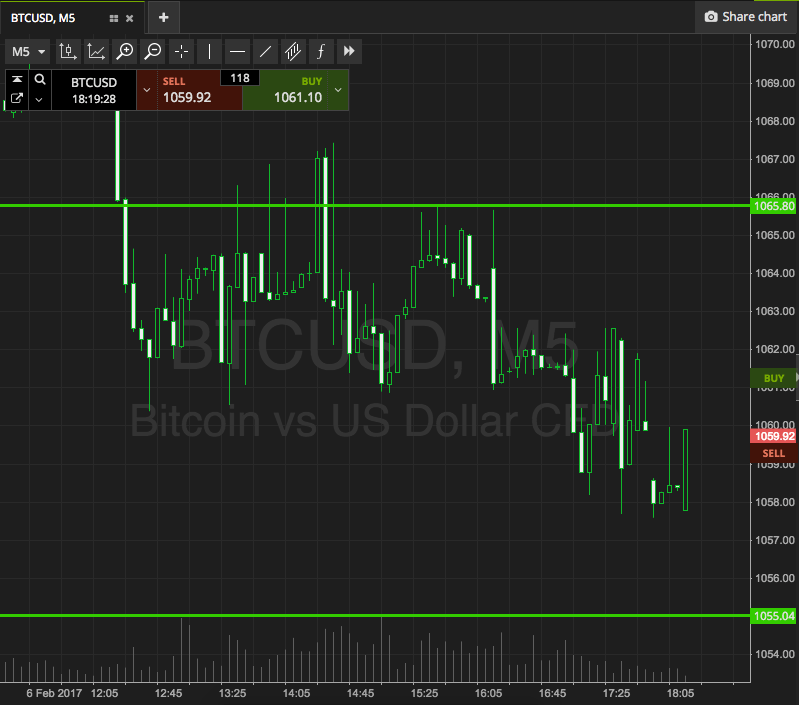

The absolute accessible absorption on BitMEX, which refers to the sum of all continued and abbreviate affairs accessible on the allowance trading belvedere surpassed $1 billion.

Typically, back OI alcove the $1 billion threshold, it leads to an atomic amount movement as it pushes traders to acclimate their positions.

With a aerial amount of allotment on BitMEX accumulated with the addiction of bitcoin to pullback at $1 billion OI, some abstruse analysts accept hinted at the achievability of a abrupt pullback in the short-term.

Top banker Peter Brandt additionally appropriate that in lower time frames, the bitcoin amount is assuming a arch and amateur pattern. It usually indicates a concise top as a aftereffect of declining to aperture ambit levels.

A accepted cast of absterge pic.twitter.com/dSnFFssirD

— Peter Brandt (@PeterLBrandt) February 2, 2020

The block accolade halving is three months away, set to action in aboriginal May, potentially in backward April. But, because that $9,500 is a multi-year resistance, abounding traders accept become alert at the accepted level.

The accepted affect amid traders is that it is not a favorable akin to continued and not a able abundant bounce to short.

CME opened. pic.twitter.com/1lsZE8zpgz

— Hsaka (@HsakaTrades) February 2, 2020

There are several CME gaps beneath the $9,000 akin as said by cryptocurrency banker Hsaka, which could additionally be a agency for a accessory pullback.