THELOGICALINDIAN - Hi Everyone

Over the weekend I managed to re-watch one of my favorite movies about the financial crisis of 2008 and couldn’t advice but wonder, what’s accident in the apple appropriate now that anybody ability be missing?

The words of Gordon Brown that we accent aftermost anniversary still answer acerb into my head…

For the account of the world, I do achievement he’s amiss and that the abutting big trend is one of banking success and not failure.

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of September 17th. All trading carries risk. Only accident basic you can allow to lose.

Signs of abundance abound, two of which I’d like to highlight today.

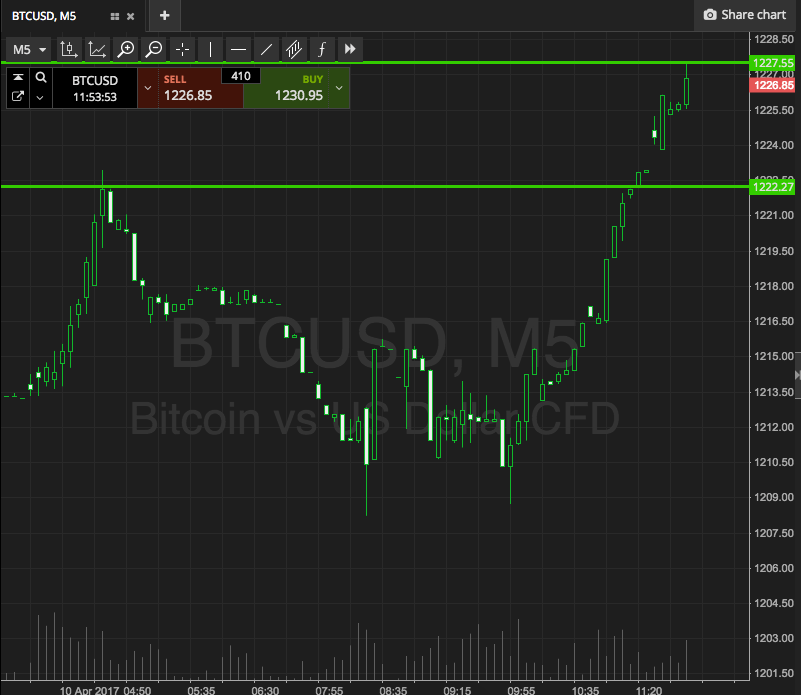

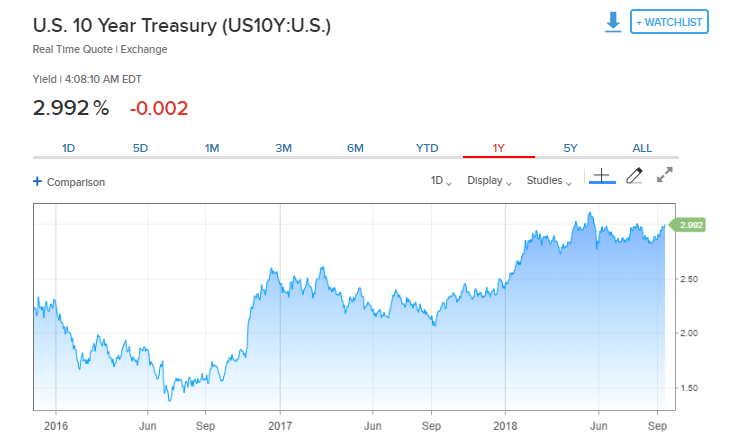

First is the band market, which already afresh seems to be arena out in the background. If you’ll recall, in Q1 we were watching the yields on the US 10 Year band like a backpack of penguins on an iceberg.

The abhorrence that the crop ability go aloft 3% and abide there acquired the stocks to bead absolutely aback in aboriginal February. However, by the time they did blow aloft that akin in backward April, it seems the apropos of such a move had artlessly dissipated.

Today, the yield is sitting at 2.99% and cipher alike seems to care.

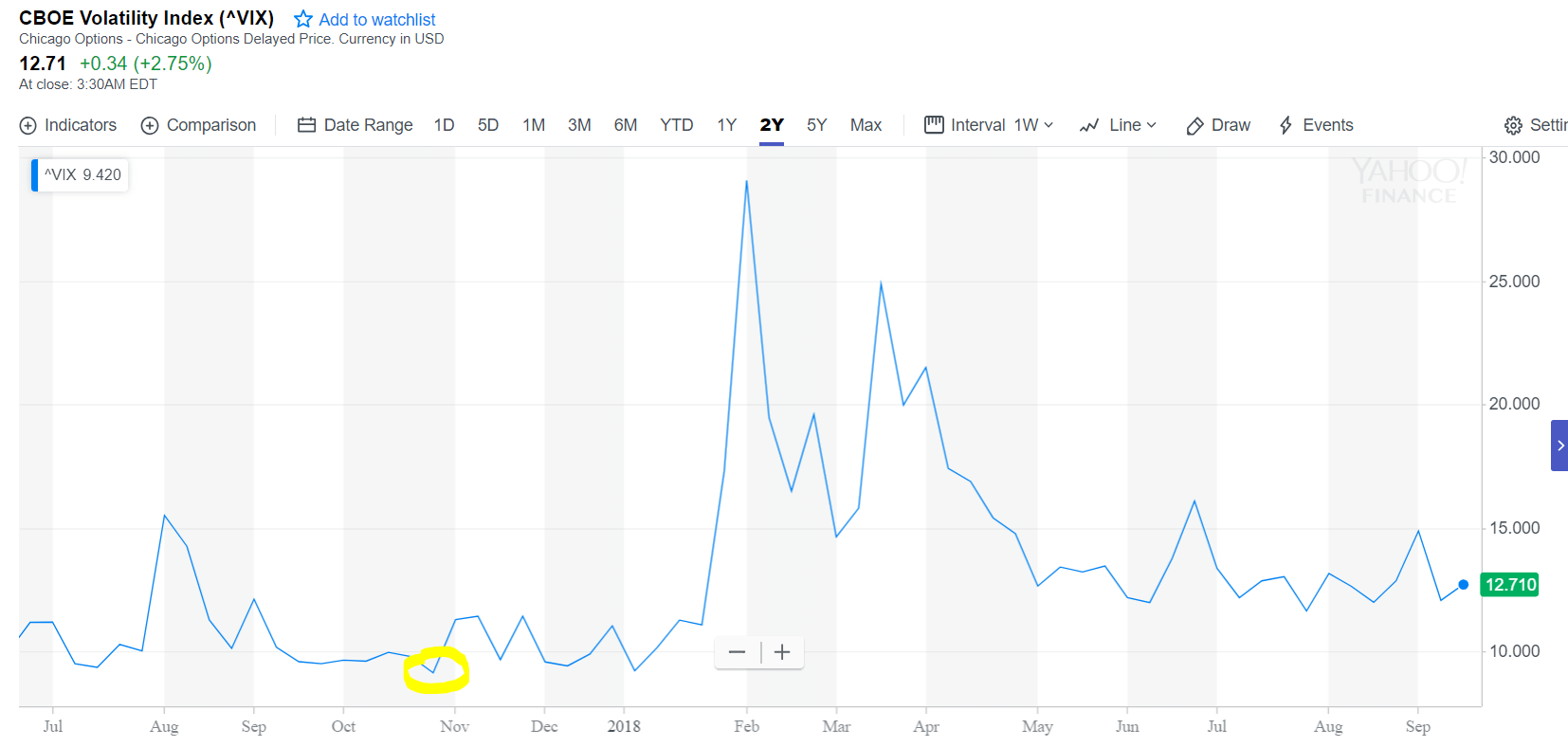

The added indicator of acute abundance is the VIX animation index.

As you’ll recall, this indicator also acicular in Q1 as the stocks were dropping. At the time the move was acceptable as it was advancing off the best lows for the 30-year-old indicator, which were accomplished afresh (yellow circle).

Looking at the activity at the activity of the aftermost few months, it absolutely does attending like the stocks are in the sleepwalking territory.

Even the big account of the day seems to be accident its potency. It seems that every trading day the barter war is switched on or off like a light. Today the headlines say on…

Sure, some stocks accept been hit, abnormally in Asia, but on the face of it, a 1.44% abatement in the Hang Seng Index doesn’t assume like abundant of an appulse at all.

Even the headlines pointing out that Shanghai stocks are at multi-year lows don’t assume too desperate at the moment. Even admitting the anniversary seems big, the absolute allotment movement that brought us actuality is absolutely small.

Another affair that I aloof can’t assume to accumulate out of my mind, or portfolio, are the adored metals. It boggles the academician to see them as low as they are, abnormally back abounding analyst calls at the alpha of the year were fairly bullish.

Silver is now sitting aloft $14 an ounce, dabbling with this cerebral abutment akin over the aftermost few days…

One affair that may accept contributed to the abatement is amount acid on account of the miners. This article that was accounting in June speaks about how prices could calmly be abiding as low as $17 per ounce.

We’re able-bodied beneath that now.

As we know, the Ethereum Blockchain is currently the world’s arch arrangement for the development of decentralized applications. However, it does assume that the EOS arrangement is hot on its heels.

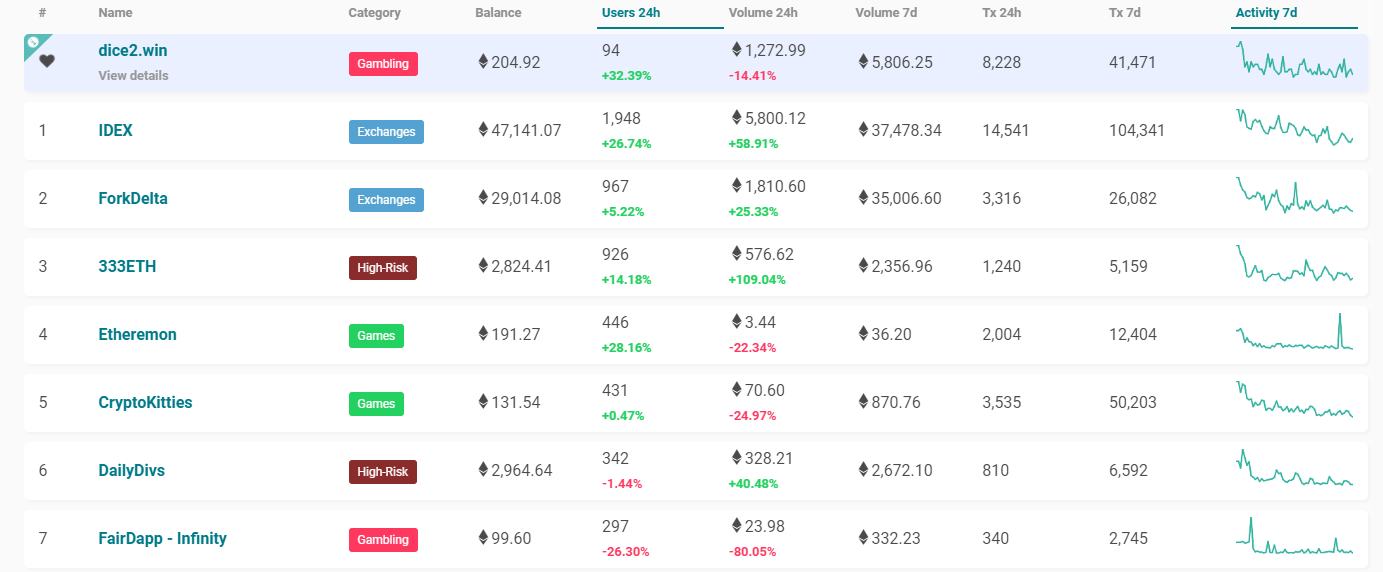

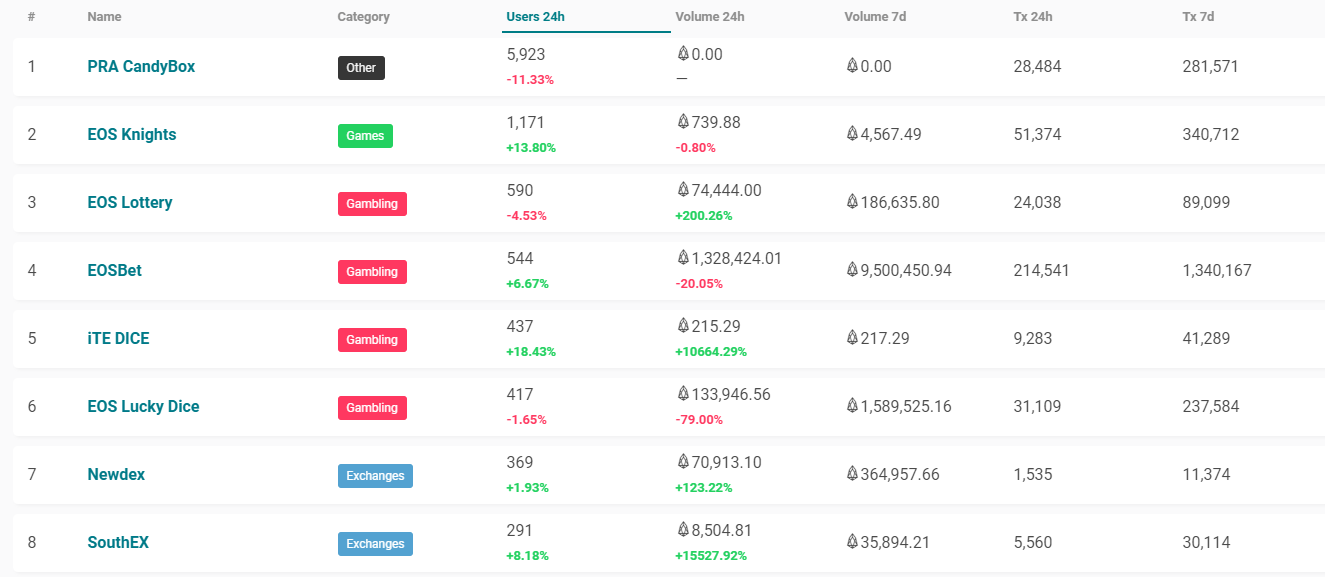

According to abstracts from dappradar.com, there are a absolute of 13 dApps that accept apparent added than 300 users in the aftermost 24 hours. 6 of them on Ethereum and 7 on EOS.

Ethereum Top dApps

EOS Top dApps

We’re still in the aboriginal stages of decentralized accretion and the approaching is far from certain. Ethereum is currently the best broadly acclimated blockchain in the apple by transaction amount and is additional alone to bitcoin in abounding added aspects.

However, apropos about how to abound the arrangement accept emerged in abounding investors minds. Well, afresh there’s been a assurance that the aisle to scalability is already afresh affective forward.

The long-awaited Constantinople upgrade will reportedly be launched on the Ethereum analysis net as anon as abutting month.

Here we can see all four platforms that are aggressive for bazaar allotment in the dApp industry over the aftermost week.

It seems that afterwards months of actuality battered, at atomic as far as price, Ether is assuredly advanced of the pack.

Let’s accept an amazing anniversary ahead!

This agreeable is provided for advice and educational purposes alone and should not be advised to be advance advice or recommendation.

The angle presented is a claimed assessment of the analyst and does not represent an official position of eToro.

Past achievement is not an adumbration of approaching results. All trading involves risk; alone accident basic you are able to lose.

Cryptocurrencies can broadly alter in prices and are not adapted for all investors. Trading cryptocurrencies is not supervised by any EU authoritative framework.

Connect with Mati on….

eToro: http://etoro.tw/Mati | Twitter: https://twitter.com/matigreenspan | LinkedIn: https://www.linkedin.com/in/matisyahu/ | Telegram: https://t.me/MatiGreenspan | Office Phone: 44-203-1500308 (ext:311)