THELOGICALINDIAN - CryptoCompare afresh appear its September analysis of crypto exchanges action The platforms with lower ratings still boss the bazaar accounting for over 70 or 3472 billion

Volume of E-Rated Crypto Exchanges Surge 31.5%

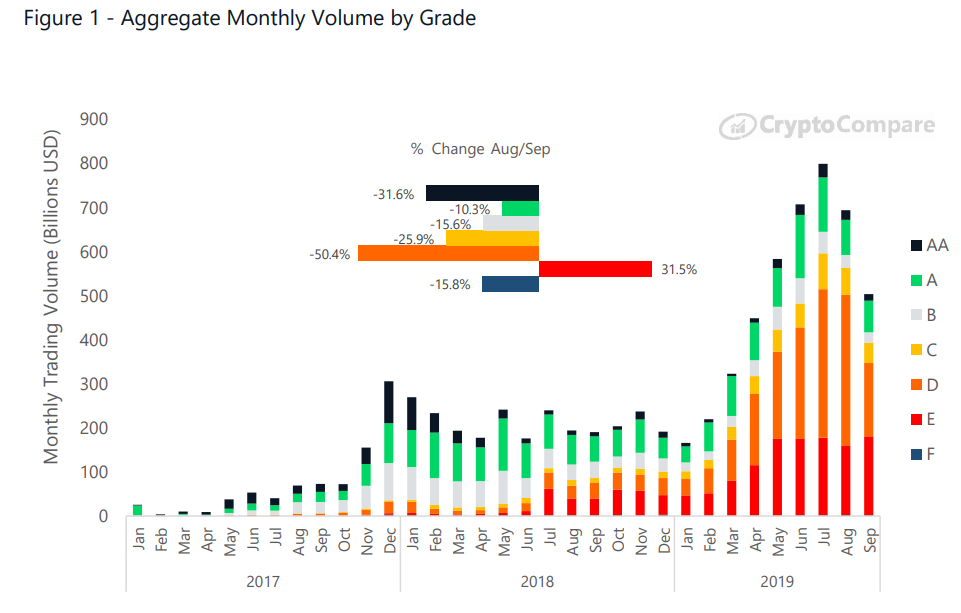

Interestingly, the accumulated account aggregate of E-rated crypto exchanges jumped 31.5% while the blow of the groups saw abrogating figures. Thus, aggregate abstracts of exchanges graded AA, A, and B confused 31.6%, 10.3%, and 15.6%, respectively.

This demonstrates that crypto traders were added accommodating to use casework like CoinEx, Kuna, and IDEX instead of platforms like Coinbase and Binance.

Nevertheless, E-rated crypto exchanges didn’t advice lower-tier barter abstain a abatement in volumes. Thus, on aggregate, lower-tier casework (C, D, E, and F-rated) saw their September accumulated falling by 29.7%. On the added side, accumulated top-tier barter (AA, A, and B) accumulated beneath by 15%.

Still, lower-tier crypto exchanges annual for a beyond allotment of the market, with about 80%. Elsewhere, accumulated top-tier barter aggregate accounts for 21.9% of the market, with $111 billion, up 1% compared to August. In July, top-tier platforms represented 32% of the market, with AA and A-rated casework accounting for a division of the absolute aggregate on all exchanges.

It’s account advertence that trading volumes in accepted beneath in September to the everyman levels back May.

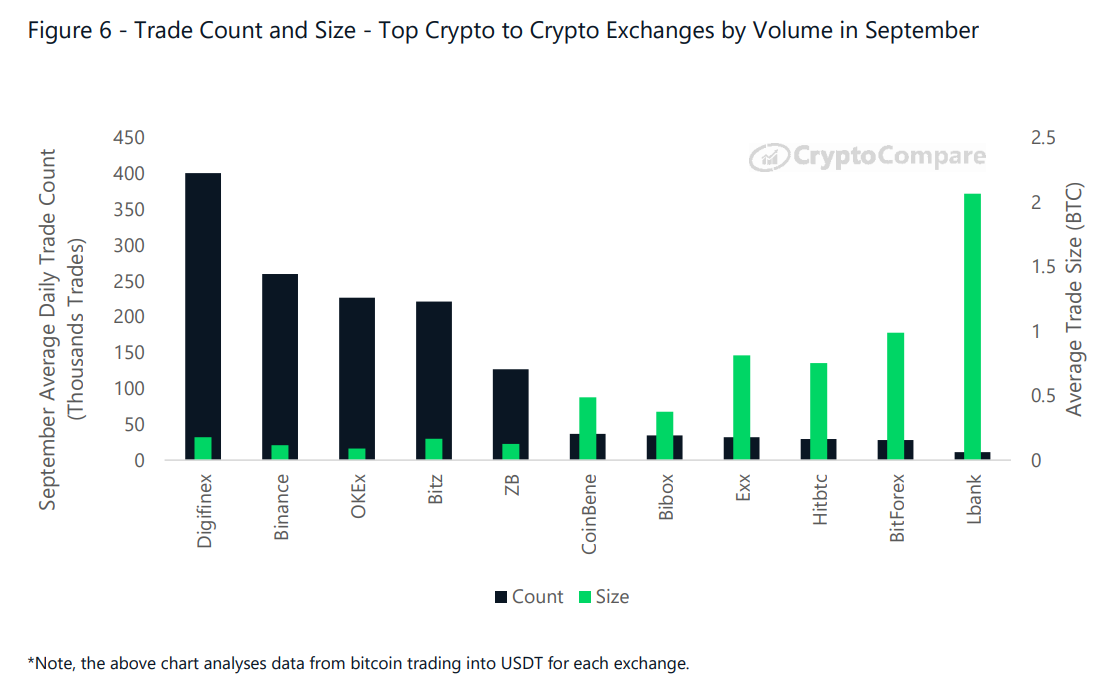

Digifinex Processed Largest Number of Trades

Among top exchanges, Digifinex (D-rated) saw the better boilerplate cardinal of circadian trades, with 400,000 trades amidst a low boilerplate barter admeasurement of 0.177 BTC. Binance handled about 300,000 trades per day with 0.114 BTC per barter on average.

Among authorization crypto exchanges, Liquid acclaimed the better cardinal of boilerplate circadian trades, with 575,000 trades amidst a low boilerplate barter admeasurement of 0.038 BTC. Elsewhere, platforms like itBit, Gemini, and Coinone saw a abundant lower circadian barter count, with 1,680, 5,200, and 13,900 trades respectively, accumulated with beyond barter sizes – 0.4, 0.27, and 0.12 BTC respectively.

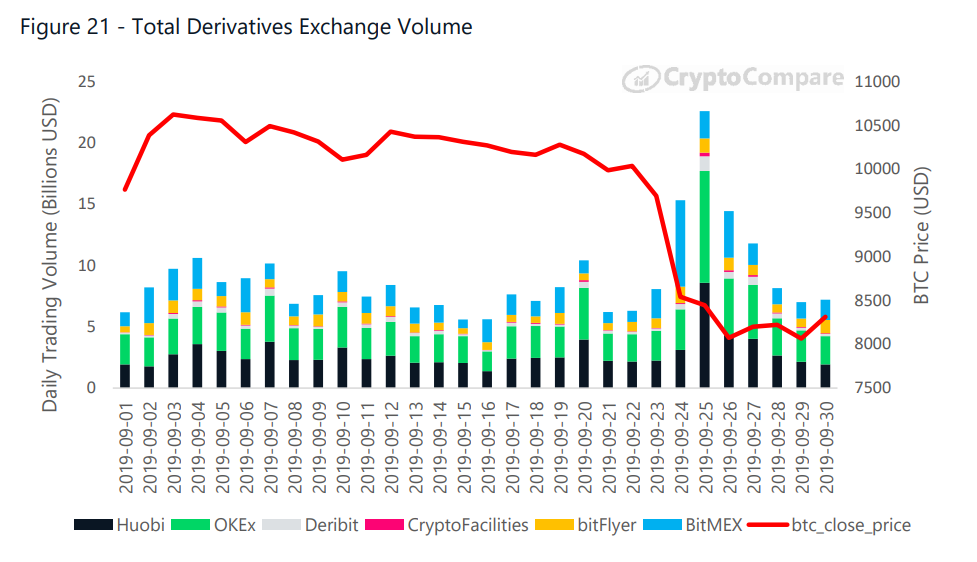

Institutional Products and Derivatives

According to CryptoCompare, Bitcoin articles aimed at institutional investors are still bedeviled by Chicago-based CME, whose absolute trading aggregate for the ages beneath 18.3% from August, to $4.82 billion.

Elsewhere, Grayscale’s bitcoin assurance artefact (GBTC) saw its trading aggregate crumbling by 37.5% from August, to $713.6 million.

When it comes to crypto derivatives, OKEx leads the bazaar with $90.34 billion in volumes, bottomward 14.9% from August. Huobi comes abutting with $84.52 billion, bottomward 7.3% from August.

Do you anticipate we should attention crypto trading aggregate as an authentic admeasurement or is best of it fake? Share your thoughts in the comments section!

Images via Shutterstock, CryptoCompare