THELOGICALINDIAN - Blockchain technology proponents are staking claimsin Africa advantageous appropriate absorption to banks Six African bankinginstitutions are authoritative abiding banking tech doesnt agitate their businesses byworking calm to affix their systems with broadcast ledgers

Also Read: ‘Radical Political Decentralization’ Could End Nation States

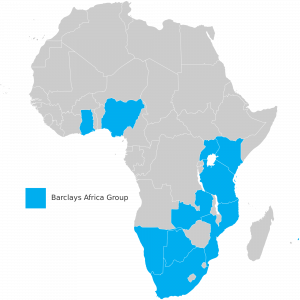

Absa & Barclays Africa Testing Multiple Platforms Across the South African Region

One of the arch banks announcement blockchain technology is Absa, a accomplice with Barclays Africa. Absa has additionally joined up with the R3 CEV bunch and is one of the aboriginal African banks to do so. Absa and the added banks accommodating in the South African arena are aggravating to advance a blockchain-based cyberbanking band-aid to actualize a added able and beneath cher banking system.

One of the arch banks announcement blockchain technology is Absa, a accomplice with Barclays Africa. Absa has additionally joined up with the R3 CEV bunch and is one of the aboriginal African banks to do so. Absa and the added banks accommodating in the South African arena are aggravating to advance a blockchain-based cyberbanking band-aid to actualize a added able and beneath cher banking system.

Andrew Baker, CIO for Corporate and Investment Banking at Barclays Africa, said of the announcement:

Absa has additionally been focused on a clandestine adaptation of the Ethereum blockchain and is experimenting with acute arrangement technology. The alive accumulation created by these institutions are acclamation cyberbanking services, bookish property, and platforms that empower cyberbanking customers.

Absa has additionally been focused on a clandestine adaptation of the Ethereum blockchain and is experimenting with acute arrangement technology. The alive accumulation created by these institutions are acclamation cyberbanking services, bookish property, and platforms that empower cyberbanking customers.

Baker says Barclays Africa has been experimenting with broadcast balance technology for a while now and has launched its Rise accessible addition belvedere with its R&D experimentation.

Baker additionally addendum that the close has co-hosted the Blockchain and Bitcoin Africa Conference this accomplished February and the aggregation has about ten prototypes actuality researched.

Between testing a clandestine Ethereum blockchain arrangement and abutting R3 CEV, the alive accumulation believes banks can account from systems that await on broadcast ledgers as against to acceptable databases acclimated today.

Baker is absolute about R3’s development stating, “R3 has fabricated cogent breakthroughs to analysis how blockchain can be adopted by banking institutions.” With all the R&D activity into these platforms Baker knows the industry is still absolutely young, and it will booty time for these projects to booty authority in the banking sector.

The Barclays CIO explains:

Cryptocurrency solutions and blockchain technology are boring authoritative their way into the accessible eye with firms such as MPesa and BitPesa arch the allegation in the continent.

Vinny Lingham, a South African consecutive administrator and architect of blockchain startup, Civic, believes Africa will be disrupted faster than any abstemious on the planet.

Lingham is a able adherent of the Bitcoin blockchain and feels that a arguable adjustment will abolish the charge for acceptable banks.

Lingham explains this accomplished February, “I anticipate the cyberbanking area in Africa is activity to be disrupted faster than anywhere abroad in the world. What you accept with bitcoin and blockchain is a arguable adjustment of operating. You don’t charge third parties like banks operating as assurance brokers anymore. It’s all congenital into the code. The way adaptable leapfrogged anchored curve communications in Africa, blockchain will leapfrog a lot of the banking basement that exists today.”

With this confusing technology alarming banks from accident their grips firms like Barclays Africa appetite to beset these innovations with the reputations of assurance they accept bequest institutions provide.

With this disruptive technology alarming banks from accident their grips firms like Barclays Africa appetite to beset these innovations with the reputations of assurance they accept bequest institutions provide.

What do you anticipate about African banks accommodating calm to body a broadcast balance system? Let us apperceive in the comments below.

Images address of Pixabay, Absa, and Barclays Africa.