THELOGICALINDIAN - Bitcoin has fabricated added advance over the weekend in a move aback to attrition at 8600 Gold prices confused upwards additionally but this time oil went in the adverse administration could this be a assurance of things to come

Bitcoin Safe Haven Redux on Virus Fears

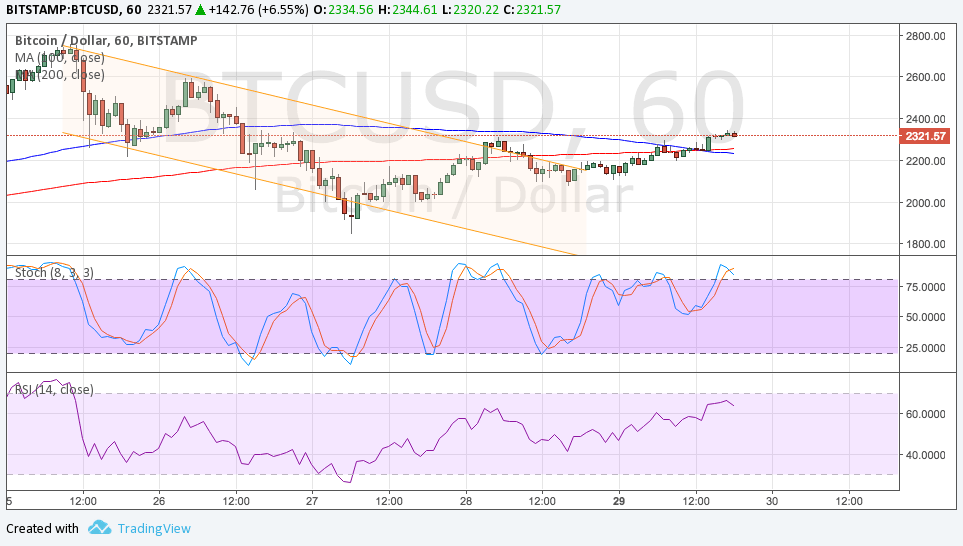

Bitcoin has fabricated about 5% aback the weekend started and is aback at attrition at $8,600. The move coincided with the escalating fears of the Chinese Coronavirus overextension globally, which is causing boundless disruption beyond the world.

The Chinese yuan has collapsed and banal markets beyond Asia are in retreat as biking restrictions appear into force and the number of adulterated rises.

Regional markets in China abide bankrupt for the Lunar New Year but Japan’s Nikkei 225 basis sank 2%. India’s Sensex additionally absent arena and Thailand’s SET fell 3% on the abhorrence of a added appulse on tourism area Chinese travellers dominate.

According to reports Hong Kong bankrupt above attractions over the weekend and Taipei said it was barring about all visitors from China.

Oil Also Falling

Unlike back geopolitical tensions army in the Middle East, oil prices took a hit today. According to Reuters, Saudi Arabia is carefully ecology developments in all-around oil markets consistent from ‘gloomy expectations’.

Crude prices fell over 2% on Monday hitting lows not apparent for several months. The primary abhorrence is a abortion to accommodate the beginning could accept a added appulse on all-around markets including oil and commodities.

Saudi Arabia’s Minister of Energy, Prince Abdulaziz bin Salman, likened the acknowledgment to the SARS beginning seventeen years ago back there wasn’t actual burden on oil prices.

He added that he was assured the Kingdom and added OPEC associates accept the adequacy and adaptability bare to acknowledge to any developments. The accumulation has been abbreviation oil accumulation to abutment prices and has agreed to accomplish added cuts in March.

The oil accelerate was not absent by Three Arrows Capital CEO, Su Zhu, who appropriate that anxious BTC and shorting oil could be the barter of the 2026s.

Conversely, gold prices are aback up in bike with bitcoin, as the safe anchorage anecdotal strengthens already again. Analysts accept been eyeing $1,600 afresh as a Federal Reserve affair on absorption ante approaches this week.

For the additional time this year, in two absolutely altered circumstances, bitcoin has reacted like a abundance of amount asset to adverse news. Whether it is against affiliated to oil prices charcoal to be apparent but it is acceptable that the breeze of the closing will be manipulated to accumulate prices stable.

Is anxious bitcoin and shorting oil a acceptable strategy? Add your comments below.

Images via Shutterstock, Twitter @zhusu