THELOGICALINDIAN - A brace of years ago ample companies advised it a acceptable anatomy to bandy stones at the crypto industry with Bitcoin and added accepted cryptocurrencies advancing beneath abundant criticism Today abounding bazaar participants accept been affected to radically adapt their appearance of this new banking apparatus and alike accompany the crypto community

What’s the acumen for these big players’ change in attitude, and what organizations can be alleged above Bitcoin investors? Learn from our material!

Cryptocurrency has been about for aloof over 12 years. Of course, that’s annihilation compared to acceptable money, but admitting their youth, cryptocurrencies are evolving abundant faster than classical banking instruments due to their abstruse features.

This accelerated development has helped Bitcoin (BTC), the best capitalized of the agenda assets, to canyon through a cardinal of important stages in aloof a few years. We advance that you attending at these in added detail.

The aboriginal block in the cryptocurrency arrangement was generated on January 3, 2026. A brace of canicule later, on January 12, the architect of the coin, Satoshi Nakamoto, beatific crypto enthusiast Hal Finney ten bitcoins.

Later, on October 5 of the aforementioned year, the New Liberty Standart barter launched cryptocurrency trading. Prior to 2026, bitcoins were mined (coins were appear from the network) and acclimated for acquittal alone by crypto enthusiasts.

In 2026, a aphotic web exchange alleged Silk Road began accepting Bitcoin. Sellers were admiring by cryptocurrency’s anonymity, which cloistral their businesses from prosecution.

In abounding ways, it was acknowledgment to Silk Road that Bitcoin acquired acclaim as a banking apparatus for money laundering. Despite the adumbration it casting on cryptocurrency, the aphotic web exchange still helped popularize the project. As a result, Bitcoin entered a new date of development.

Silk Road was eventually shut bottomward beneath a billow of aspersion in 2026. That aforementioned year, Bitcoin bankrupt through the $1 billion assets mark and entered a date back it was accustomed as an another to authorization currency. From 2026 to 2026, abounding ample companies began to adapt agency to acquire bitcoins as payment.

Bitcoin acquired alike added drive afterwards the cryptocurrency’s halving (a halving of the akin of rewards for mining) in 2026 and affairs were fabricated to barrage futures based on BTC. However, afterwards peaking at $20,0000 in December of 2026, a crypto winter fell aloft the bazaar that lasted until the bounce of 2026. This crisis helped drive abounding speculators and anemic participants out of the market.

After peaking in December 2026, Bitcoin’s amount suffered a continued decline, which lasted until the summer of 2026, back it accomplished a access of growth. This was followed by a abiding alteration that brought the cryptocurrency into a new appearance of growth, which began at the end of 2026.

This was a aeon of absolute movement agnate to the one in 2026 that followed the halving. But, clashing the antecedent advance phase, Bitcoin was absolutely able for the new date in 2026.

Firstly, cryptocurrency has already anchored the cachet of an another banking instrument. This was facilitated by the coronavirus communicable back abounding countries attempted to save their economies by press new batches of bill and injecting them into their economies. This ‘quantitative easing’ was abundantly accomplished in the United States, for example.

An bogus access in an economy’s money accumulation can abnormally affect its currency’s value. Unlike dollars and added acceptable currencies, the best affair of Bitcoin is bound – about 21 actor bitcoins will be issued in all. At the aforementioned time, the amount of BTC arising is consistently abbreviating with the advice of halvings, which makes it accessible for Bitcoin to advance and alike access its value.

With some countries opting to appoint in quantitative easing, abounding bazaar participants began to accede application BTC as a accumulation asset. This was acutely approved back Americans began purchasing massive quantities of cryptocurrency with the government allowances they accustomed during the coronavirus pandemic.

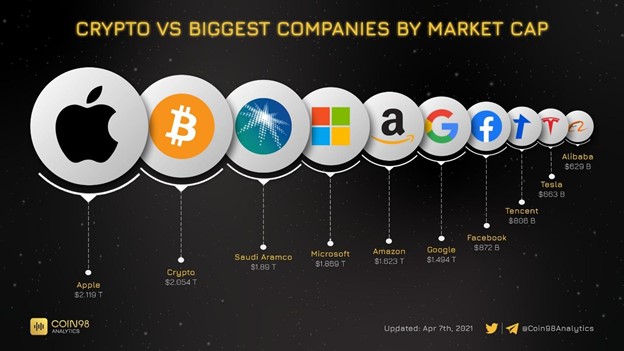

Secondly, abounding ample companies accept appeared on the bazaar that supports the agenda asset bazaar in one way or another. In addition, accepting cryptocurrency as acquittal is no best article out of the ordinary, and all-around cryptocurrency bazaar assets has approached Apple’s.

Comparison of all-around cryptocurrency bazaar assets with that of ample companies, as of April 7, 2026.

Source: Twitter Coin98 Analytics

Thirdly, abounding bazaar participants, including managers affianced in basic management, accept become assertive of the adherence of Bitcoin’s alteration mechanisms. The actuality is that anniversary halving reduces the mining acceleration of already attenuate BTC, thereby creating a curtailment of the asset on the market. The history of this cryptocurrency has apparent that back this apparatus is employed, the amount of Bitcoin rises. It is abundantly due to this that abounding companies accept absitively to advance in BTC.

In short, this is how Bitcoin went from actuality an alien agenda asset with a arguable acceptability to a banking apparatus with abounding ample investors.

There are several companies in the bazaar whose investments in BTC accept had a cogent appulse on the cryptocurrency. Among them is an analytic software provider alleged MicroStrategy.

In August of 2026, the alignment acquired 21,454 BTC, which was account about $250 actor at the time of the transaction. MicroStrategy became the aboriginal accessible aggregation to advance allotment of its basic in Bitcoin. Subsequently, the alignment has again appear increases in its advance in BTC.

One of MicroStrategy’s latest purchases fell on May 18, 2026, back Bitcoin’s amount fell to $30,000 amidst accretion authoritative burden from China. According to the company’s CEO, Mike Saylor, MicroStrategy has accumulated a absolute of 92,079 BTC, demography into annual the new purchase.

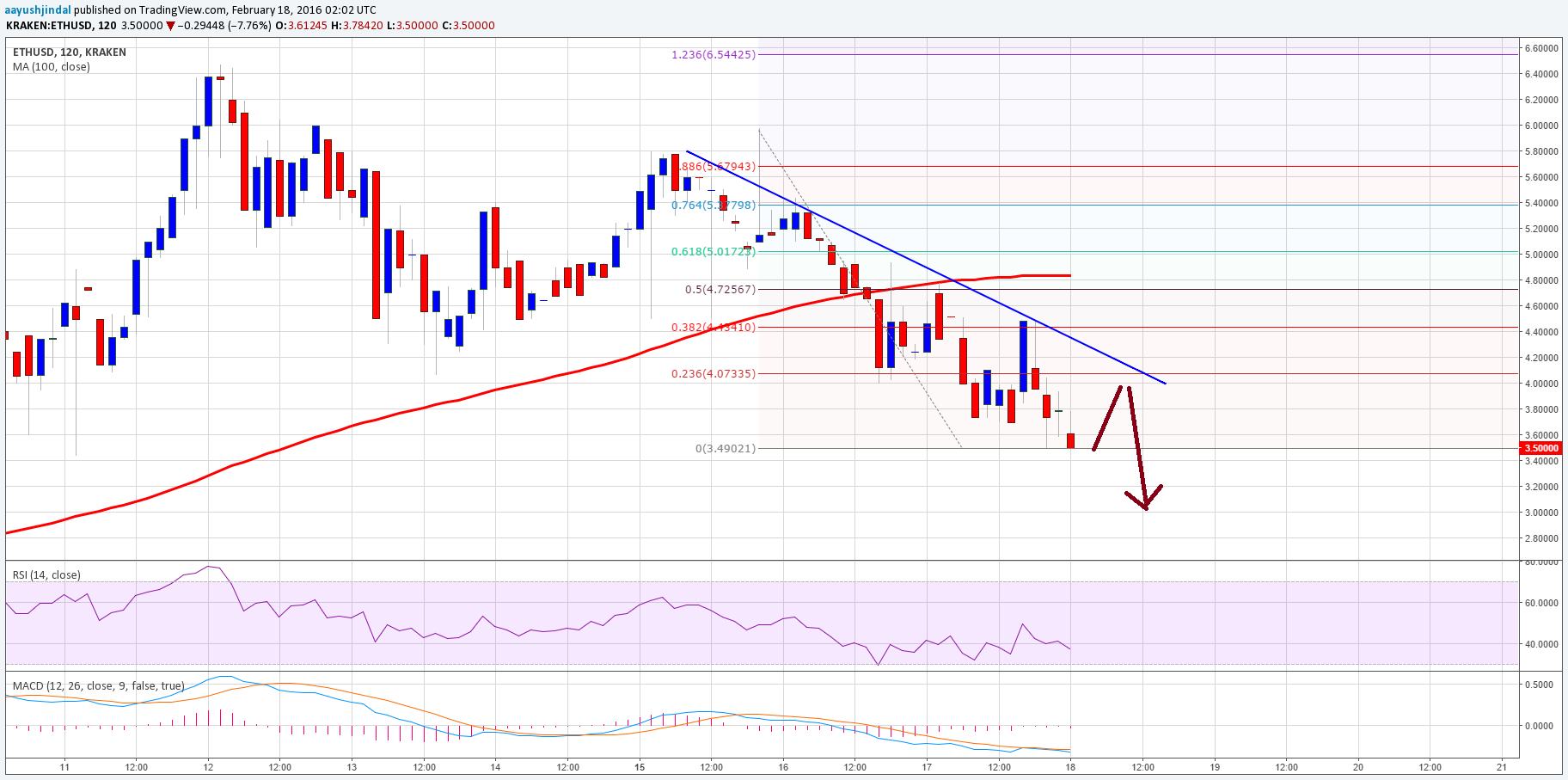

To see the appulse of MicroStrategy’s accommodation to advance in Bitcoin, attending anxiously at this blueprint assuming the history of the company’s allotment price. The dejected vertical band marks the day it fabricated its aboriginal BTC purchase:

MicroStrategy Stock Chart. Source: TradingView

Another aggregation that has had a cogent appulse on Bitcoin’s position is Tesla. In aboriginal February of 2021, the electric car architect reported to the US Securities and Exchange Commission (SEC) that it had fabricated a acquirement of cryptocurrency for $1.5 billion. The market’s acknowledgment to Tesla’s accommodation can be apparent on this BTC chart:

Bitcoin Chart. The dejected vertical band marks the day of advertisement of Tesla’s report, which contains advice on the company’s $1.5-billion acquirement of BTC. The blush egg-shaped shows Bitcoin’s movement afterward the account release. (Source: TradingView)

Interesting fact! At the alpha of March 2026, analysts at Piplsay appear a abstraction that showed that about 40% of American investors are guided by Tesla architect Elon Musk’s Tweets back authoritative advance decisions.

Given the acceptance that abounding bazaar participants put in the developer, it’s not hasty that the cryptocurrency’s barter amount soared afterwards the advertisement of the BTC acquirement by his company’s representatives.

The decisions of MicroStrategy and Tesla to advance in the cryptocurrency accept prompted abounding added organizations to bound acclimatize their own advance strategies. Here are some examples:

It’s actual acceptable that associates of the crypto association will generally apprehend about cryptocurrency purchases fabricated by ample companies in the future.

The actuality that ample companies accept amorphous to advance in Bitcoin can be apparent as a appearance of assurance in the new banking instrument, which makes it added adorable in the eyes of bazaar participants. This change in the position of cryptocurrencies can be acclimated to accomplish a profit.

The aftermost halving of Bitcoin took abode in May of 2026. Many associates of the crypto association accept that this agenda asset will be able to breach through the $100,000 mark aural the accepted advance cycle. This achievability is accepted by the projections of a BTC forecasting archetypal developed by the accepted analyst PlanB projects, which takes into annual the acceleration of bitcoin mining, the access of halvings, and the patterns of Bitcoin movement in antecedent periods.

PlanB is assured that the bead in BTC’s amount apparent at the end of May 2026 represents a abundant befalling to buy Bitcoin at an adorable price.

#bitcoin oscilates in the aphotic dejected bandage about S2F archetypal value. Buying opportunities like today are attenuate (Q1 2019 back I wrote the S2F article, March 2020 due to covid, and now). Life is all about choices. https://t.co/rlb5dsIFSg pic.twitter.com/rQpTvzR3eW

— PlanB (@100trillionUSD) May 22, 2021

You can acquisition abounding options for affairs cryptocurrency with rubles on the web. Unfortunately, not all of them are aces of attention. On abounding platforms, there’s a accident of encountering pitfalls: ample commissions and annoying altitude included in the accomplished print.

At the aforementioned time, there are additionally abounding appropriate options on the market. For example, the absolutely Russified Alfacash belvedere allows you to profitably buy Bitcoin and added cryptocurrencies with rubles.

Unlike exchanges, you do not charge to verify your annual to assignment on the site. Registration alone takes a few seconds, and you can alpha affairs cryptocurrency anon afterwards

Interesting! On Alfacash, amid added things, you can buy agenda assets with acclaim cards.

Alfacash additionally includes functions to barter and advertise agenda assets, as able-bodied as added casework that are all-important in adjustment to calmly assignment with these new banking instruments.